YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

A Springfield-based solar energy company is suing one of its former executives and OakStar Bank for allegedly conspiring to create a competing finance and leasing program with trade secrets that were in violation of a nondisclosure agreement.

In a petition filed April 15 in Greene County Circuit Court, Sun Solar LLC’s lawsuit names former employee Adam Stipanovich, OakStar Bank and its renewable energy financing division BrightOak LLC, which the financial institution launched in January 2019.

According to the petition, while still a Sun Solar employee, Stipanovich violated the company’s nondisclosure agreement he signed in March 2017 when he “used, disclosed, transferred, and divulged information, documents, records, proprietary/confidential information/documents, and trade secrets about and regarding plaintiff’s solar finance/leasing business to OakStar.” The company also accused OakStar in the petition of coercing Stipanovich to leave Sun Solar and assist OakStar to develop a competing solar finance and leasing business and become a bank employee.

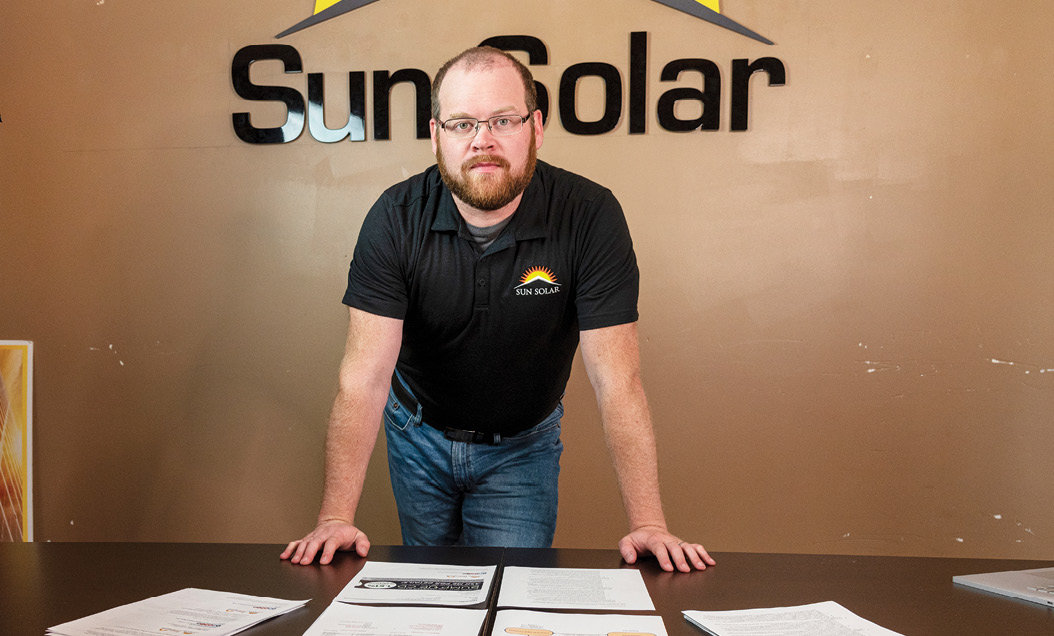

Stipanovich resigned Oct. 26, 2017, as Sun Solar’s vice president of commercial and utility scale development and was hired less than a week later by OakStar, according to Sun Solar owner and CEO Caleb Arthur. Adam Stipanovich is president at BrightOak, which also employs five other former Sun Solar workers, Arthur said in an exclusive interview with Springfield Business Journal. He said OakStar has been aggressive over the past two years in pursuing some of his company’s workers, characterizing the actions as “poaching.” The hires by OakStar include Eugene Han, former president and general counsel at Sun Solar. He now works as executive vice president and general counsel for BrightOak.

Arthur said the alleged actions that form the basis of the lawsuit took place over several months around October 2017. Sun Solar is represented in the case by Steven Marsh and Jason Shaffer of Hulston, Jones & Marsh LLC. The petition lists 11 counts against the defendants: malicious trespass; computer tampering; conspiracy – computer tampering; violation of nondisclosure agreement; conspiracy to violate nondisclosure agreement; disclosure of trade secrets; conspiracy to disclose trade secrets; tortious interference with contract – nondisclosure agreement; breach of duty of loyalty; conspiracy to breach of duty of loyalty; and unjust enrichment.

According to the petition, Sun Solar alleges OakStar employee Jimmy Stilley, who is currently BrightOak’s CEO, “conspired and acted in concert with Stipanovich to transfer, obtain, divert and appropriate plaintiff’s trade secrets and plaintiff’s solar finance/leasing business for the benefit of OakStar and to the detriment of plaintiff, all in violation of the nondisclosure agreement.”

As a direct result of the actions by OakStar and Stipanovich, Sun Solar is seeking at least $4 million in damages. The company alleges in the petition damages include lost customers and vendor relationships, business development costs, as well as future business opportunities and operations.

“It could possibly go much higher than that,” Arthur said of damages sought. “We won’t know until they start disclosing how many loans and leases they did. That was just a very rough estimate we think the opportunity is so far that we’ve missed out on by not having our own program.”

OakStar Bank President and CEO Randy Johnson, as well as BrightOak executives Stipanovich, Stilley and Han, didn’t respond to multiple requests seeking comment by press time. No attorney of record is listed at this time for the defendants, according to the Case.net online management system.

Arthur said he intended to promote the finance and lease program to other solar companies before his issues with OakStar emerged.

“I’ve missed out on probably between $50 million to $100 million worth of financing leases I could have rolled out throughout the Midwest to other solar companies to help them that OakStar took from me and rolled out to other solar companies,” he said.

Per the agreement, Sun Solar received no money upfront at signing of the lease or installation, Arthur said. He said the company had to build at least $400,000 worth of projects before they could be submitted every 90 days for funding from OakStar. Sun Solar submitted $6.7 million in projects over the course of the program, he said.

Arthur said in 2016 he directed Stipanovich to help create and develop a Sun Solar subsidiary to process tax credits and finance sales and leases of solar equipment. The business was organized in October 2017 with the secretary of state’s office as Impact Financial LLC.

Arthur said the leasing program process was started in February 2017, adding Sun Solar followed legal advice from Kansas City-based Husch Blackwell LLP to partner with an established lender such as a bank. That led Sun Solar to connect with OakStar Bank. Arthur said the process was similar to what car dealerships do with banks, asking them to finance customers on their behalf.

“What I didn’t know at the time was there would ever be an instance where OakStar Bank would like my business model so much that they would take my employees and take my business model and run with it,” Arthur said, noting his company has retrieved deleted emails off its server from Stipanovich that document the alleged activity with OakStar.

Work history

Stipanovich, who started with Sun Solar in January 2015, was more than a trusted employee to Arthur, noting he once considered him his best friend.

“He was really my right-hand man. He went everywhere with me,” Arthur said. “He moved up through the company. At one point, he ran my operations and was my business development director, overseeing my sales.”

Arthur said Sun Solar invested over $300,000 into launching the lease program. He said he trusted Stipanovich with creating the documents, adding OakStar and Husch Blackwell also were involved in the process. Arthur signed the master lease agreement in June 2017 but said he was unaware until then that Sun Solar would be responsible for covering payments if customers defaulted on their leases.

“I just took (Stipanovich’s) word for it that this program was being developed on Sun Solar’s behalf,” he said, noting it created a “huge financial risk” for Sun Solar.

“OakStar got to keep all the leases; they got to keep all the tax credits,” Arthur said. “I signed up the customers and then I had to cover all the customers’ payments for a full 20 years. And if any customer defaulted on their payment, I got hooked covering the payment for them. I didn’t know any of that before I signed the agreements.”

Arthur said he feels taken advantage of but admits he should have better monitored the program rollout.

“I guess I was naive,” he said. “I’m a handshake type of business owner.”

Most solar companies only sell and install the products, but through the program he wanted to also be involved in financing.

“If I just focused on selling and installing, I wouldn’t have gotten in this mess,” he said.

When the lease program first rolled out, Arthur said Sun Solar did all the underwriting, which included running credit checks and collecting customer payments. But in January 2020, he said OakStar told him it was amending the lease arrangement and using BrightOak, its own financing company, to handle the underwriting.

“That’s when I knew they were fully cutting me out, where I could no longer control any of it,” he said. “There’s been a lot of damages to my business model. It took me a lot of cash to build this program and launch it and take that risk.”

Taking action

Arthur said he wanted to file the lawsuit in 2020 when OakStar changed the lease agreement but he couldn’t financially afford it at the time.

“It was either pay payroll or pay attorneys for a lawsuit,” he said. “I’m finally taking it on because I finally have the resources.”

In 2017, Sun Solar was the top-ranking local company on the annual Inc. 5000 list for fast growth, with 2016 revenue of $24.5 million. Its 2014-16 revenue growth rate was 1,140%, according to past Springfield Business Journal reporting.

However, the company’s revenue has dropped and employee count has been stagnant in recent years, Arthur said, citing the lease program issues. Last year’s revenue was $19 million, and he said the company, which has offices in Springfield, Columbia, Houston, Kansas City and St. Louis, hit 100 employees in December 2015. However, he said it hadn’t employed more than 110 until this year.

However, Arthur said the company is back in growth mode this year, boosting its employee total to 185 and is on pace for $30 million in revenue. Part of that increase is due to connecting in January with Old Missouri Bank as a new banking partner for its leasing program. Sun Solar’s in-house financing helps people who want to utilize solar energy but can’t necessarily afford it or don’t qualify for federal tax credits.

“I had to find a bank that was willing to work with me and understand my position that I was in with my previous relationship,” Arthur said. “I want a bank to respect my business that I’m building.”

OMB spokesperson Ryan Bowling said the bank declined to comment on Sun Solar’s pending lawsuit and its working relationship with the company. The leasing program currently isn’t promoted on the websites of the bank or Sun Solar.

Last month’s filed lawsuit isn’t the only one Sun Solar is pursuing. The company also has an active lawsuit with Jerry Fussell and Solar Solutions of Missouri LLC. Arthur said that case involves allegations that Fussell, one of his former employees, downloaded a list of customers and sold them to Solar Solutions while he still worked for Sun Solar. That case, filed in October 2020, is still pending, according to Case.net.

The case against OakStar has been assigned to Greene County Circuit Judge Michael Cordonnier. According to Case.net, no court hearings for the case were scheduled as of May 17.

A franchise store of a Branson West-based quilting business made its Queen City debut; Grateful Vase launched in Lebanon; and Branson entertainment venue The Social Birdy had its grand opening.

$2M in tax credits awarded to SWMO nonprofits

Baldwin, Lathan to chair United Way campaign

Produce recall impacts food sold at Walmart, Aldi and Kroger

Mixed-used development proposed in KC area

Tax deduction program for farmers set to launch

Report: Panera explores sale of Caribou Coffee, Einstein Bros Bagels