YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Legislators are hopeful this is the year Missouri catches up to the rest of the country by collecting sales taxes on out-of-state retailers that conduct e-commerce in the Show-Me State.

The conversation has been ongoing since the U.S. Supreme Court ruled the “Wayfair decision” two years ago in South Dakota v. Wayfair, eliminating the physical presence for a sales tax nexus. It allows states to impose sales taxes, 4.25% in Missouri, on online businesses with in-state gross sales exceeding $100,000.

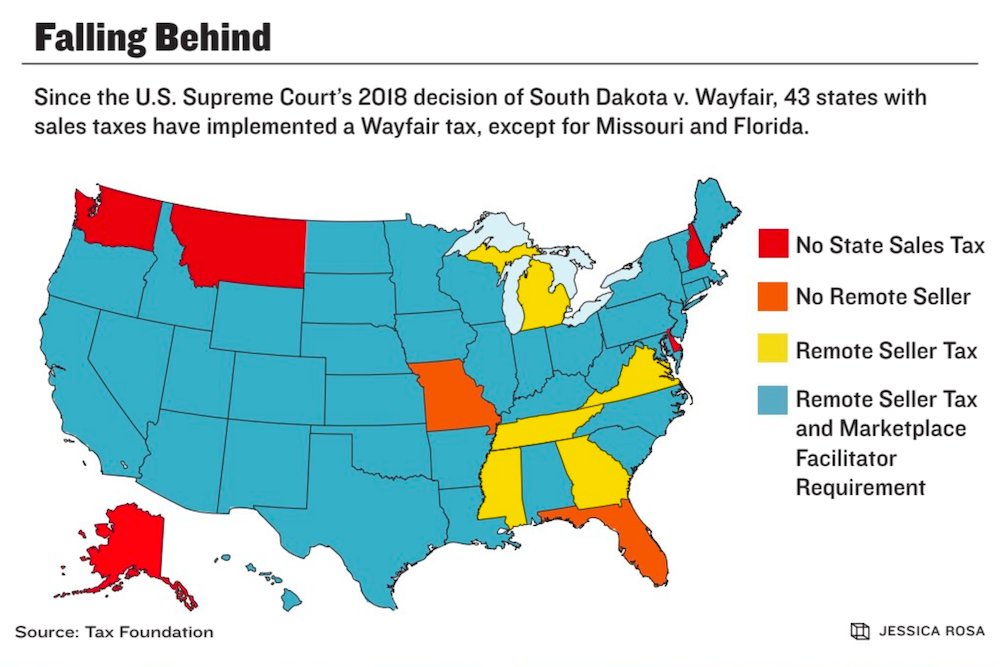

Two years later, Missouri and Florida are the only states with sales taxes that have not passed related legislation since the Supreme Court decision. Four states – Oregon, Montana, New Hampshire and Delaware – do not have a sales tax, and Alaska has local sales taxes but not a state tax. Thirty-eight states have also enacted tax regimes that obligate marketplace facilitators, such as e-commerce platforms Amazon and eBay, to collect taxes on behalf of their sellers, according to a 2019 report from national tax policy nonprofit Tax Foundation.

Total U.S. e-commerce sales in 2019 were estimated at $601.7 billion, an increase of nearly 15% from the year prior, according to a recent news release by the U.S. Census Bureau.

Several Missouri proposals died in committee last year, and a handful of lawmakers have backed efforts this year to get legislation across the finish line – a task House of Representatives Speaker Elijah Haahr projects will happen by the session’s end in May.

“We started in a better position this year with the legislation,” Haahr said. “On the House side, the Wayfair legislation just came out of the Ways and Means Committee unanimously. … My hope is that we’ll have it on the floor before the legislative spring break.”

Haahr, R-Springfield, said Missouri has lagged because the state’s tax code is more complicated than other states, and lawmakers haven’t come to an agreement on what to do with the tax collections.

Missouri has more than 2,200 sales tax jurisdictions of the more than 10,000 sales tax jurisdictions in the country, according to a Tax Foundation report.

Additionally, Missouri has to pass a law to enact a Wayfair tax, unlike 23 states that are members of the Streamlined Sales and Use Tax Agreement which adopted the policies collectively as part of the agreement, according to the Streamlined Sales Tax Governing Board Inc. website.

“It’s a tough one to crack,” Haahr said of the Wayfair legislation. “Our goal is protecting those brick-and-mortar retailers across the state and making sure they are competing in an equitable and fair manner with online retailers.”

Wayfair Inc. (NYSE: W) is a Boston-based online retailer that sells furniture and home decor. The company lost its claim that South Dakota’s e-commerce tax in 2018 was unconstitutional, kicking off the national online taxation trend.

The proposals

Most lawmakers agree the Wayfair tax is important for the state, said Rep. J. Eggleston, R-Maysville, who’s sponsored a bill in the House.

“Some members want to keep it and spend it, but that becomes a tax increase to the people. There’s other people that think this is an excuse to get rid of corporate income tax,” Eggleston said.

During Gov. Mike Parson’s recent State of the State address, he suggested the state create a cash operating expense fund to the tune of $100 million this year. To ensure the fund remains stable, he suggested directing the Wayfair collections to the fund until it becomes solvent; then, the state could use the collections to pay off debt and pay for infrastructure programs.

Haahr said the state already has a financial safety net in place, and he thinks the money should be returned to state residents.

Eggleston’s proposal, House Bill 1957, was heard at the beginning of March by a rules committee, and Haahr anticipates it will be read on the House floor before month’s end. The proposal would require companies with cumulative gross receipts of at least $100,000 from out of state to pay an in-state use tax, and register with the Department of Revenue to collect and remit use taxes. It also would reduce the top income tax rate by 0.14% in 2021, followed by tax adjustments until 2023.

“That way, we’re helping brick and mortar better compete with their online counterparts without creating an extra tax for families,” Eggleston said.

The bill’s fiscal note indicates the first year implementing the use tax would generate roughly $130 million in tax collections. According to the Hancock Amendment, new annual revenue imposed by the General Assembly that exceed 1% of total state revenue must be approved by voters. Eggleston said the use-tax collections would exceed this limit, which is why he’s suggesting an income tax rate cut that would help the implementation become general revenue neutral.

Additionally, Republican Sens. Mike Cunningham, Denny Hoskins, Andrew Koenig and Sandy Crawford and Democratic Sen. Lauren Arthur have each filed bills that would enact a Wayfair tax. Haahr said he’s eyeing Koenig’s Senate Bill 648. Senate President Pro Tem Dave Schatz could not be reached for comment by press time.

Koenig’s proposal, which modifies several provisions related to taxation, would create a use tax nexus set for 2022 that directs tax collections to the general revenue fund. He also proposes an income tax cut by 0.15% that’s enacted if net general revenue exceeds $150 million.

“We’re basically incentivizing people to make purchases outside of Missouri,” Koenig said. “It’s important to have a level playing field. … Broadening out the base and cutting taxes elsewhere makes it general revenue neutral.”

Cunningham, of Rogersville, is sponsoring a bill that includes Parson’s rainy-day fund. Cunningham declined to comment, and his legislative assistant noted the senator generally does not accept interview requests.

His proposal, SB 529, would enact a use tax that applies to retailers with one-year cumulative gross receipts of at least $100,000 and create a cash operating expense fund, as suggested by Parson.

Local priorities

Springfield Area Chamber of Commerce President Matt Morrow said Cunningham’s bill aligns best with the chamber’s priorities for local businesses. The Wayfair legislation was high on the chamber’s priorities, and the group has three lobbyists registered with the Missouri Ethics Commission.

Nearly 1,450 retailers are licensed to do business in Springfield, according to recent city data.

“There are important investments the state needs to make to make sure we’re competitive,” Morrow said. “And there’s a hole in the boat since we haven’t been collecting this tax. The decision has been delayed long enough.

“We’re falling behind every day we don’t do something.”

Haahr said implementing a Wayfair tax is necessary for all businesses in the state.

“It’s a good leg up for the businesses of Missouri,” Haahr said. “They’re competing with 49 other states for customers now with e-commerce and putting this in place puts them on a level playing field.”

A franchise store of a Branson West-based quilting business made its Queen City debut; Grateful Vase launched in Lebanon; and Branson entertainment venue The Social Birdy had its grand opening.