YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Missouri’s transportation system is a step closer to accruing more than $450 million annually in additional funding. The boost hinges on state lawmakers approving a fuel tax increase.

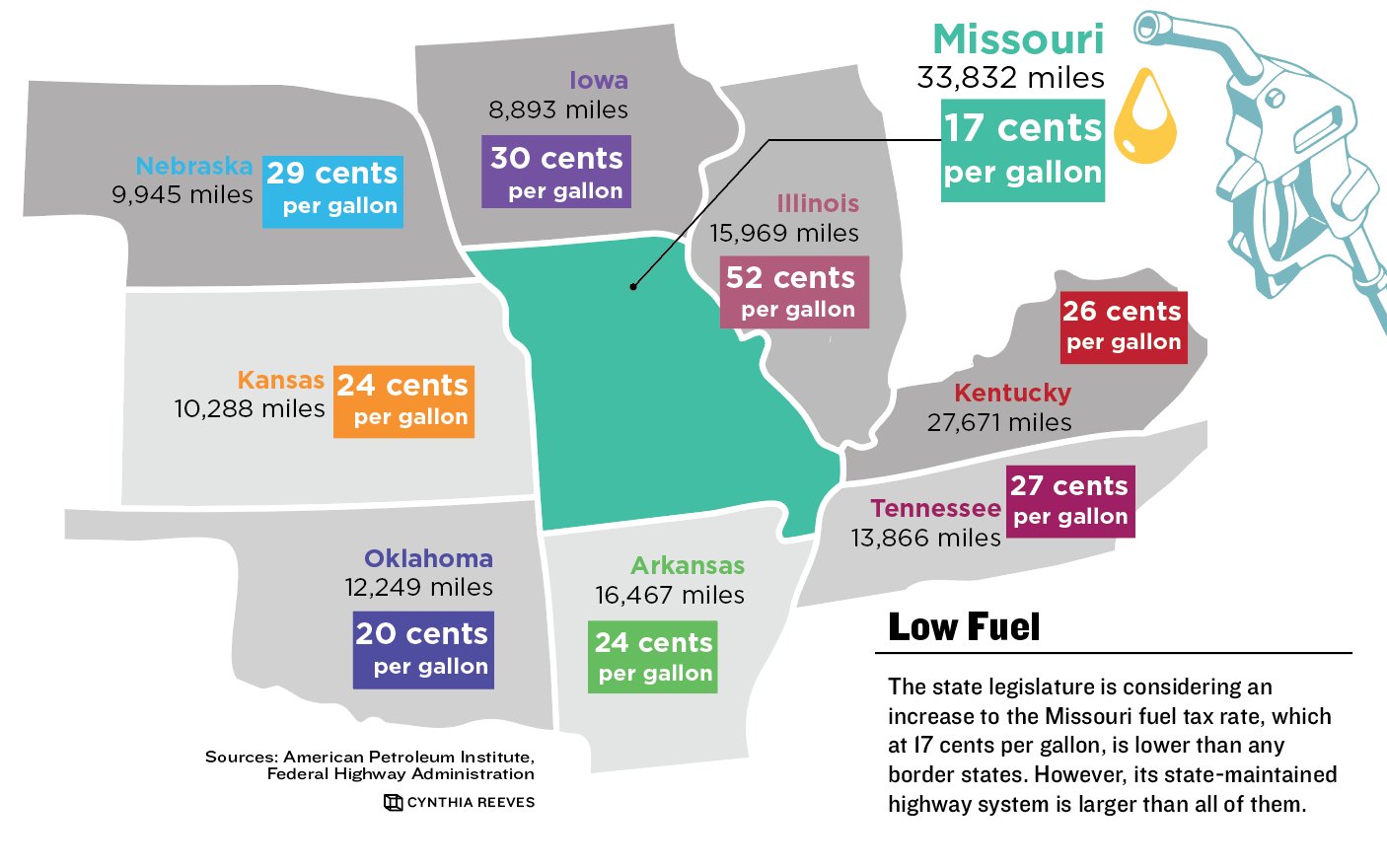

In late April, the Missouri House Transportation Committee unanimously approved Senate Bill 262, moving the issue to the full House of Representatives. The legislation seeks to boost Missouri’s fuel tax rate for the first time since 1996, which at 17 cents per gallon, ranks 49th in the nation, officials say. The tax increase would generate more than $450 million per year for the Missouri Department of Transportation to address roads and bridges.

The bill sponsored by Senate President Pro Tem Dave Schatz, R-Sullivan, intends to address the state’s reported $825 million annual transportation funding shortfall. The Senate approved the legislation in March. It would increase the fuel tax by 2.5 cents annually for the next four years, reaching 29.5 cents by 2025.

The Missouri Chamber of Commerce and Industry is among the bill’s supporters.

“The leader of the Missouri Senate filed the bill,” said chamber President and CEO Dan Mehan. “That tells me what I need to know about how important it is in the Missouri General Assembly. It’s just a question of whether we can get that one more vote.”

The clock is ticking on the bill coming to a vote before the session ends May 14.

Still, Mehan said he’s optimistic the measure will get to the House floor for debate.

“It’s got better odds than we’ve ever had,” he said. “We’ve never been closer to having success in this area.”

However, one local politician said he plans to vote no.

“This bill is a relatively small tax increase, but it is a tax increase nonetheless,” said state Rep. Alex Riley, R-Springfield, via email. “We do need to invest more in our state’s infrastructure, but at a time when many of our neighbors are still trying to recover economically from the government-imposed shutdowns of the past year and gas prices have been spiking upward toward $3 a gallon since the Biden administration took power in January, it does not seem prudent to raise taxes on our hardworking citizens now.”

Under study

A study conducted by North Carolina-based consulting firm Economic Leadership LLC released last month analyzed the economic impacts of the bill. The state chamber funded the report, which Mehan said is part of a Missouri Can’t Wait statewide advertising campaign. Chamber officials did not respond to requests for campaign and study costs by press time.

The report showed that passing Senate Bill 262 could lead to an economic impact over $1.8 billion statewide. The economic activity would result in an increase of $722 million in earnings across the state and create over 17,000 jobs. Economic Leadership said in the report its research relied specifically on estimates provided by MoDOT on the amount of revenue generated from the fuel tax increase and total road miles that would be repaired annually with the new funding.

Sean Thouvenot, vice president of Branco Enterprises Inc., said the number of its road and bridge construction projects – and jobs accompanying them – will likely grow if the tax increase is approved. But he said the gas tax’s benefits go beyond the construction industry.

“It’s also beneficial for the trucking industry and for the average, everyday person that drives to work,” he said, noting the Missouri Trucking Association is in favor of the bill.

Missouri is a transportation hub with interstates 44 and 70 and the state’s road system of nearly 34,000 miles, which is seventh largest in the nation. Thouvenot said the system is taking a beating.

“We’ve got to do something because the roads are falling apart,” he said. “The bridges are terrible.”

Branco works on six to 10 MoDOT road and bridge projects annually in southwest Missouri, Thouvenot said, noting they generally make up about 30% of the company’s workload. It currently is general contractor for MoDOT on bridge rehabilitation projects totaling $4.2 million.

“It’s not a major thing for us that’s going to make or break us,” he said of the benefits for Branco. “We just believe that we need it.”

Different proposition

A component of the gas tax bill that addresses lawmakers’ concerns of a tax hike is a rebate mechanism. Missouri drivers can save their receipts and apply for a refund of the increased portion of the tax once a year with the Department of Revenue. Commercial industries, such as trucking, would not be eligible for rebates. Mehan said the program was inspired by a similar one established four years ago in South Carolina.

“It’s a significant change from what Proposition D was,” Mehan said about the Missouri fuel tax increase defeated by voters in 2018.

If the refund option was part of Proposition D, Thouvenot said the voting outcome likely would have been different.

“This is a voluntary tax in nature,” he said. “In 2018, what everybody fails to realize for Proposition D is that 1.1 million people voted for it. Around 1.2 million voted against. It was that close.”

The bill also phases in an increase for electric vehicle fees and creates the Electric Vehicle Task Force within the Revenue Department. “This 12.5 cents over the span of its lifetime is constitutionally protected,” Thouvenot said, noting he expects the measure will pass in the House. “It can’t be used for anything but the road and bridge fund.”

Infrastructure help

While Mehan said transportation funding via the gas tax has stagnated for 25 years, the state legislature did approve Gov. Mike Parson’s Focus on Bridges program in 2019. It aims to improve or replace 250 of the state’s poorest bridges, according to MoDOT. The $351 million program is funded by $50 million in state general revenue from the fiscal 2020 budget, and by $301 million in bonding from state general revenue over seven years.

Help also could be coming from the federal government, as President Joe Biden is advocating for a $2.3 trillion infrastructure package. However, U.S. Senate Republicans oppose the size and scope of the plan and have countered with a $568 billion proposal.

Mehan said passage of the fuel tax hike could signal to federal authorities that Missouri is serious about infrastructure improvements. Parson has championed investment in infrastructure since taking office and is supportive of the bill, he said.

“Gov. Parson has made infrastructure in general – and with the primary focus on roads and bridges – a priority of his administration,” Mehan said. “There’s one more vote we need in the House. If it gets to his desk, he’s going to sign it.”

Missouri State University’s science building, built in 1971 and formerly called Temple Hall, is being reconstructed and updated.