YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

A bill passed on the final day of the 2021 Missouri legislative session is set to level the playing field between local businesses and their online competitors.

The “Wayfair tax” – named after the 2018 U.S. Supreme Court case South Dakota v. Wayfair Inc. that ruled in favor of the tax – applies a city or state’s sales tax rate to online purchases from vendors who are not located in that state.

“In more recent years, obviously the way people shop has changed, and there wasn’t really a provision for collecting that same tax for online retailers, particularly if those retailers were selling in Missouri but from another part of the country or world,” said Matt Morrow, president of the Springfield Area Chamber of Commerce.

Missouri statute only allows the state to collect sales tax from businesses that operate within the state. Missouri Senate Bill 153 modifies the definition of “engaging in business activities within this state” to include retailers with cumulative gross receipts over $100,000 from the sale of tangible property within the state.

If SB 153 is approved by Gov. Mike Parson, business that meet the criteria will be required to collect and remit sales taxes based on current rates. The bill was sent to the governor’s desk on May 25, and Rep. Alex Riley, R-Springfield, said legislators expect him to sign it. Parson mentioned creation of the tax as a priority in his 2021 State of the State address.

Under the bill, the Wayfair tax, also called a use tax or remote sales tax, would take effect in 2023. SB 153, sponsored by Sen. Andrew Koenig, R-Manchester, passed in the House 145-6.

Riley said a Wayfair tax in Missouri has been considered but not passed since the Supreme Court decision.

“This has been something the Missouri legislature has been working on for a number of years, and it’s always been politically difficult to get done because here in Missouri, our people don’t like tax increases. Our legislature – which is overwhelmingly Republican – doesn’t like tax increases,” Riley said. “We had to come to some sort of compromise that would ensure we weren’t putting a new tax increase on the citizens.”

Going into the 2021 legislative session, Missouri was one of three remaining states without a use tax. By the time the bill was passed in the House, it was the last – Kansas and Florida had passed similar bills earlier in their respective legislative sessions.

“One of the reasons I thought it was so important to get this done is, without it, the state basically favors out-of-state businesses that don’t have a footprint in the state because they impose sales taxes on our brick-and-mortar businesses. But there are not the same taxes imposed on businesses located out of the state,” Riley said.

He said the bill was able to pass with an overwhelming majority and bipartisan support because it also included an income tax decrease.

The bill includes an income tax reduction of 0.1% from the top rate in 2024. It also adds two additional 0.1% reductions to already scheduled reductions of 0.5% phased-in by 0.1% over a period of years which go into effect if net general revenue collections meet certain trigger levels, according to the bill.

The chamber included support for creation of an online sales tax collection mechanism in its 2021 legislative agenda, Morrow said, because the tax is widely supported by local business owners looking for that level playing field. Chamber representatives went to the Capitol to advocate for the bill.

The Wayfair tax will make online purchases the same as in-person purchases, Morrow said, where before, an online purchase may not include a sales tax. It is not an additional tax on top of sales tax.

“If you were to go and purchase a bedroom set at a local furniture store, in addition to the purchase price, you’d be paying sales tax for that,” Morrow said. “Whereas, in theory, without this fix, you could go buy the same bedroom set at the exact same price from an out-of-state online retailer and save some money by not having to pay sales tax.”

Jessica Harmison-Olson, managing partner of Maxon Fine Jewelry, is one member of the Springfield business community who supported passage of a Wayfair tax in Missouri and made the trip to Jefferson City on behalf of the chamber as part of The Network for Young Professionals.

“One of our biggest competitors is online sales, and with COVID, people are doing it more and more,” Harmison-Olson said. “We have a brick-and-mortar store here in town, and we support the community and employ local people, so it was important for us to level the playing field by being able to collect that tax. It makes it a little more fair.”

Harmison-Olson said it’s hard to quantify the direct impact from online shopping on her business. U.S. consumers spent an estimated $861 billion online in 2020 – up 44% from 2019, according to e-commerce research website Digital Commerce 360.

“If (customers) would come in, and they’re comparing apples to apples, your final amount is going to be less if you’re purchasing it online, because I have to charge sales tax,” she said. “It’s important to our society, it helps with education and infrastructure, so it essentially comes back to us, and it’s important, but this helps make it a little more equal.”

On top of leveling the playing field for local businesses, implementing a Wayfair tax brings in additional sales tax revenue for state and local municipalities. Taxes collected on online purchases would go toward the same programs and public services as existing sales tax at the same percentages.

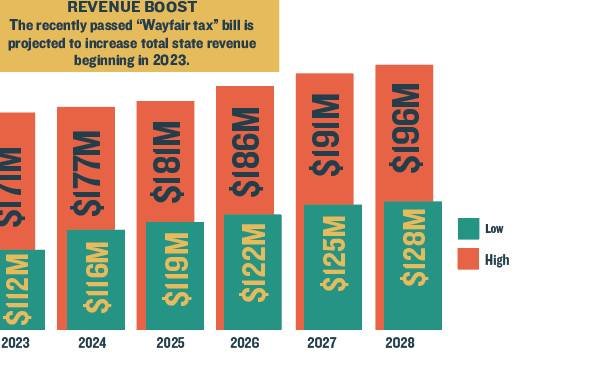

Missouri’s use tax is estimated to potentially increase total state revenue as much as 52% annually – up $130 million to $198.5 million total – once it is fully implemented by fiscal 2029, according to Senate documents. Estimated revenue for 2023 ranges from $79 million to $121 million.

However, the estimations are uncertain due to an inability to determine the current level of participation in use tax by out-of-state retailers.

“It’s very hard to estimate, and the reason it’s very hard to estimate is because there’s no denominator for the fraction,” Morrow said. “There’s no way to measure what hasn’t been collected, because it’s never been collected. There are many estimates, but they vary widely.”

Moseley’s Discount Office Products was purchased; Side Chick opened in Branson; and the Springfield franchise store of NoBaked Cookie Dough changed ownership.