YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

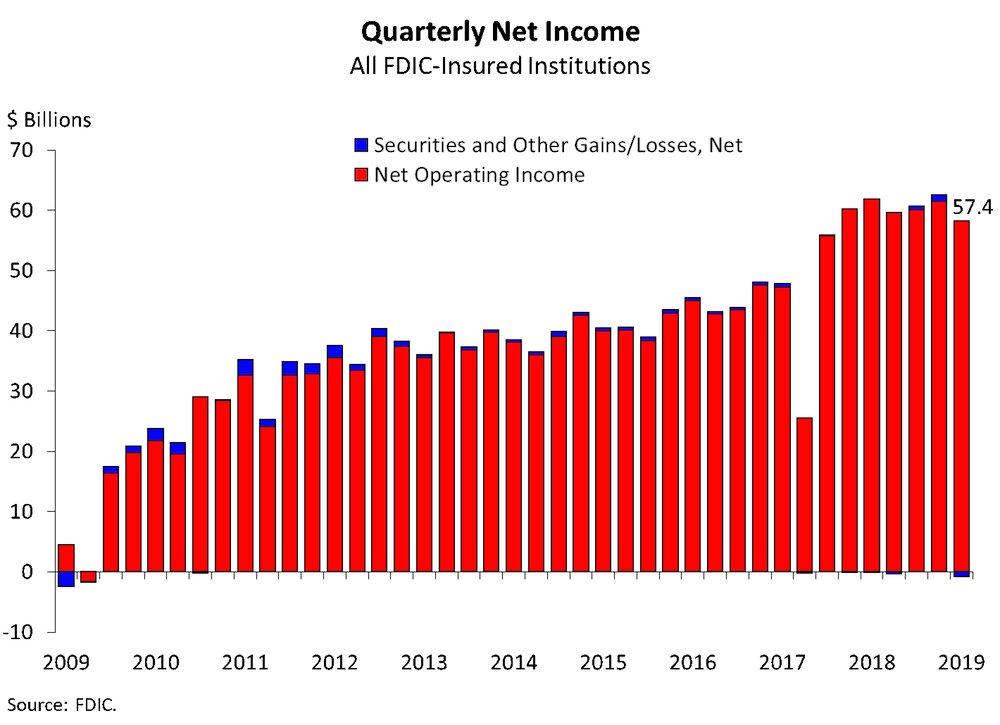

The 5,256 commercial banks and savings institutions insured by the Federal Deposit Insurance Corp. together reported $57.4 billion in third quarter earnings, a 7.3% drop from a year earlier.

FDIC officials in a news release cited “nonrecurring events at three large institutions” for the quarterly decrease in profits. However, Springfield’s two publicly traded banks — Great Southern Bancorp Inc. (Nasdaq: GSBC) and Guaranty Federal Bancshares Inc. (Nasdaq: GFED) — each reported lower earnings during the quarter.

“Overall, the banking industry reported strong loan growth, and the number of ‘problem banks’ remained low,” FDIC Chairman Jelena McWilliams said in the release, referring to banks that are at risk of failure.

Third quarter financial notes for FDIC-insured institutions:

• While overall net income was down, 62% of the institutions posted an increase in earnings compared with a year earlier.

• Community banks — making up the vast majority, at 4,825 — posted net income of $6.9 billion, a 7.2% jump.

• No banks failed during the third quarter.

Alair Springfield is first Missouri franchise for Canada-based company.