YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

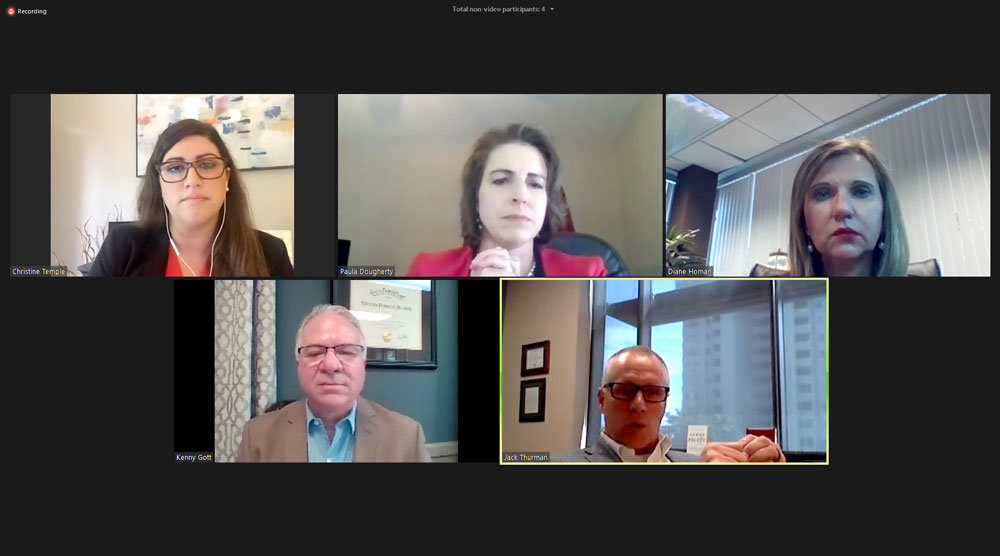

Springfield Business Journal Features Editor Christine Temple discusses financial planning with Paula Dougherty, private wealth adviser with Ameriprise Financial Services Inc.; Kenny Gott, president of Piatchek & Associates; Diane Homan, executive vice president and Springfield market executive of Central Trust Co.; and Jack Thurman, partner at BKD Wealth Advisors LLC.

Christine Temple: What is the one word to describe your industry in 2019, and then another word for 2020?

Paula Dougherty: For 2019, unprecedented. In 2020: pivotal.

Diane Homan: For 2019, robust, and for 2020, cautious.

Kenny Gott: For 2019, I’d say exuberant. It was a big market year. And 2020 I’d say surprised, by the pandemic, but also by stock markets so quickly getting back into positive territory.

Jack Thurman: This may sound a little bit negative, but clueless. We had no idea what was in front of us in 2019. Yet 2020, a much more positive word is resilient.

Pandemic planning

Temple: Talk about COVID-19’s impact on financial planning.

Dougherty: Every company is unique but faces the same concerns, such as returning to work versus now, are they going to work permanently at home? How are they going to protect employees? How are they going to protect customers? How are we going to communicate going forward? I personally had never heard of Zoom before February. Now it’s become a way of life.

Homan: We are a client relationship business. When that suddenly stops and you can’t have your face-to-face meetings, you don’t have employees in the office, you have to resort to the tools that you have. We try to continue to have as many meetings as we can. We’ve had to cancel client events, which is difficult. We are continuing our plans that we had for 2020, we’re continuing our system upgrades; that’s even proven to be more essential than we thought it would be now that we have to rely on technology more and more.

Gott: For financial planning for individuals and families, it depends on where they sit. For those who are retired on a fixed income from Social Security or pension, supplementing that with reasonable distributions from investment accounts, some need a little reassurance that their long-term plan is still working. If they were nervous before, they’re more nervous now. We always say it’s better late than never to get started on that plan and get a retirement analysis from a professional. Maybe you’re better off than you think, and if you’re not you need to know it so you can make adjustments. People who are in the workforce who are worried about their jobs are putting their budgets where they can just like businesses: holding off on discretionary spending, socking away the stimulus checks. Nobody’s taking anything for granted in this economy.

Homan: For individuals, what we are seeing, as well, they are revisiting their plan more frequently while they may have revisited their plan every two years. They don’t know what to expect in the future and they want it to be as realistic as possible. That’s just come to the forefront of their mind. Let’s look at it. I’m going to give you more detail than I ever have before.

Thurman: I’d go ditto. That would be exactly where our clients are. Just give me more rational, more detail and more realistic.

Homan: Our wants and are needs are changing, as well. What is the difference between my wants and my needs? Maybe I don’t have to put all of my wants in my plan. Maybe that’s not going to be realistic.

Temple: And that goes to the cautious that you said at the beginning. Are people changing their investment portfolios?

Homan: Surprisingly for our clients, we have had little change in their asset allocation. For the most part, people stay the course, and that comes from education from the last 10 years. That’s hard sometimes when the market’s going great and they’re making 10%, 20% on their equity portfolio over time. But we say, “OK, remember 2008, how are you going to feel if your portfolio goes down 30%?” We just have to rein them in sometimes.

Thurman: If we didn’t start educating our clients … after 2008, 2009, you’re going to have clients that are just going to go nuts in the early stages of the pandemic. (We spent) time educating … on what we call the five Ps: prior preparation prevents poor performance. When they did have the plan and they had the education, they were like, “OK, I don’t like what’s going on in March and April of this year,” but they were a lot more resilient and tolerable because they said, “You know what, we’ve already been through this.” People that didn’t have plans got crazy. But we only had two or three – over a thousand clients – that went 100% cash in the midst of this.

Temple: Kenny, you mentioned that the stock market bounced back rather quickly. Was that what you anticipated?

Gott: Stock markets always come back, and that’s the drum we always pound with clients. The average downturn, since the Great Depression through 2008 … took a little over three years for stocks to drop, hit bottom and come back all the way up to what they were worth before. We pound this drum continually with clients between recessions, and we have a plan so that they know what to do and what we’re going to do with their distributions. If they’re taking money out of their accounts each month, for example, which is pretty common, how are we going to manage that through a downturn? It’s the one thing that people really mess themselves up on.

Dougherty: We started talking to our clients toward the end of last year about what an unprecedented year it was, but then don’t expect a repeat of this. We’re heading into an election year and there’s going to be some volatility. Then around the spring, we all know what happened. I had a client say, “Well, you said this was going to happen.” And I said, “Oh, not for this reason I didn’t.” We had very few people panic, and they feel confident they’re on track with regard to their situation thanks to the conversations that we all have with our clients. We all realize that we’re part of our client’s team and that a good, solid plan is worthwhile and worth its weight, especially in these fearful times and times of uncertainty.

Measuring the economy

Temple: We hear this commentary that the market is not the economy. What are the other kinds of economic metrics that you’re looking at? Are you looking at unemployment rates?

Thurman: Yes, plus inflation. You have a monetary policy that’s totally unprecedented. I have an economics degree and there is no way in the world they ever taught us, as much as I love Drury [University] … that you could have a monetary policy like we’ve had, and we would not have inflation of any significance in the midst of it. So we’re looking at inflation because right now, as we understand it, you could have hyperinflation or possibility of deflation. Not to say that they’re out of whack yet.

Homan: The fundamentals [are] not there to explain what’s happening. We don’t understand what’s going on. When your fundamentals don’t follow what’s happening, you just have to look at all the dimensions out there: unemployment, what’s going on with inflation, interest rates. Sometimes the market doesn’t respond how it should in those times and at those levels.

Thurman: Fortunately, it didn’t respond the way it should.

Homan: That’s right, Jack.

Thurman: We’re very blessed right now. I don’t know if it’s President Trump’s positive mental attitude, but we’ve got a “super V” in our recovery. There is no fundamentals that say that we should be having this type of market recovery or economic recovery.

Gott: The kind of planning we do is designed to take into account whatever happens in the economy and Congress, whatever crazy things they do in Washington with tax policy or anything else. There’s no predicting the markets. There was a big study of … predictions over a 14-year period, about 6,500 predictions. They were about 48% successful, worse than a coin flip. You don’t need to predict the market for it to grow your money. The overall stock markets work great for the long term. It’s up about 85% of the time. It’s not like Las Vegas where the house wins most of the time. And we can plan for the other 25% of the time when markets are down. If you notice that everyone’s buying up toilet paper and you think, “Oh, maybe I should invest in Charmin,” well by the time you get to the phone, all the other thousands of investors in the world have the same idea and they’ve already driven the price up. You’re never going to be beat the market that way. The good news is you don’t have to; it simplifies your approach to have a plan, so you don’t have to worry about what the markets do or what Congress does – and then you adjust as needed.

Election season

Temple: 2020 is a very divisive election year. What do you know about election years and how that predicts behaviors? How does that affect investment portfolios?

Gott: We looked into the effect of presidential election years on investing performance because it’s such a common question. Like most other types of predictors, they really don’t work. It becomes background noise to the broader markets. What the stock markets like is predictability. The less the government does, the more the markets like it.

Dougherty: It’s speculative at best to try and predict what the outcome of the election’s going to be and all of the policy implications that either party could impose. What we do know is how well the economy is doing is a significant influence on the election. I’m sure we’re all getting that question: “Who’s going to win it and what’s that going to do to my portfolio? What’s that going to do to the economy?” We would be remiss to even give a definitive answer in that arena.

Homan: For us, having part of our business on the trust administrative side and estate tax planning, one of the main issues that we are talking to our high net-worth clients about is the state tax exemption and what might happen there depending on a new party coming in. I have clients that are right now getting things in place so that they can pull the trigger toward the end of the year if another outcome comes along.

Dougherty: Typically now about 45 days before the actual election, we start to see a lot of volatility. What we’re telling them is we’ll get through this, no matter what the outcome. Our focus for the economy needs to be figuring out a vaccine … and moving past all of this. We’ll do it.

Gott: People assign way too much credit and blame to elected officials for the performance of the stock market, the economy, gas prices, inflation, you name it. Any news cycle event, including an election, can have a temporary effect on stock prices, up or down, but in the end, it’s the fundamentals of those individual companies in the stock market that really drive the train.

Thurman: We encourage our people and our clients to turn off the media. Right now, whether it be CNN or Fox, they’ve got talking heads that are really literally just talking heads. Very few of them are practitioners like the people on this call, and very few of them are actually focused on clients’ planning. They are focused on selling a book or selling their time. We encourage our people to stop listening to the media; start focusing on your plan.

Homan: Now, more than ever, if it sounds too good to be true, it is.

Fiduciary rule

Temple: Can you shed some light on regulation regarding the fiduciary rule? This summer, primarily Democratic members of Congress, penned a letter to the Department of Labor regarding financial advisers and their fiduciary duties, asking that they reinstate this five-part test. What’s your take on it?

Dougherty: I can’t believe it’s rearing its ugly head again. It remains to be seen what’s going to come out of Washington. We work really hard to do what’s in our clients’ best interest. We work with our clients through financial planning to make sure that their goals line up with where they’re heading. There’s still a lot that remains to be seen, evidently, since it has reared up again.

Gott: (It’s) focused on clients moving their savings from a workplace savings plan, like a 401(k), over to an individually owned IRA. Advisers are financially motivated to transfer a 401(k) to an IRA under their management. So the new rule, called Regulation Best Interest, is supposed to define the circumstances under which an adviser can be held to the legal standard of acting in the client’s best interest regardless of how it may benefit the adviser. Some in Congress feel there are too many loopholes. If an adviser really puts themselves in the frame of mind of acting as a consultant, instead of a salesperson, then clients will know what they’re getting, why it’s better than the other alternatives, including leaving it where it’s at, and what it’s going to cost them. If you also include how the adviser gets paid on that, then a client’s going to be an informed consumer. That’s really the goal of the rule. It’s good for the clients, and it’s good for the reputation of our industry. Regulators are going to have to provide ongoing guidance, including examples of gray areas and close-call violations, until the industry can get their hands around it. There’s a lot of confusion around this. It’s kind of a strange hybrid between the fiduciary rule for securities licensed advisers and the suitability rule for insurance professionals. It’s neither and it’s both. The language is really convoluted and hard for brokerage compliance departments to interpret, let alone consumers.

Thurman: When we do more by giving them individual advice, now they’re saying, “No, we want you to do something different.” Would you make up your mind what you want?

Adviser workforce

Temple: I want to get into just your businesses. Tell me about the workforce pipeline. Do you have enough recruits, and where are they coming from?

Thurman: No one really wants to share about this because it is tight. It’s tight in Indianapolis, Houston, San Antonio, where we have other offices, to find quality people that manage money, just like the three other people talking here. We’ll have to have 50 applicants to have a young Paula or a young Kenny or a Diane. We’ll have to interview a whole lot. Whether it be Springfield or any other market, it’s really tough to find quality advisers that really, really care about clients, and then they’re technically astute on top of that. (Missouri State University) puts out some of the best people, and we recruit at (Indiana University), (University of Missouri), Purdue [University], UMKC, etc.

Dougherty: I agree with you on Missouri State University – and all the local colleges – that they just have a financial planning department that is second to none. It seems like a lot of the candidates that come out of there are ready to sit for the CFP. That’s a kudos to them. You can teach the technical part, you hope that people are interested in that piece of the business, but they’ve got to come with some ethics and they’ve got to come with some integrity. At this stage of the game by the time you’re ready to hire, you hope they already have that. It’s a tough market, but once you find those individuals, they’re golden.

Gott: Our most recent addition has a commercial lending background but also taught personal finance in the Springfield school system, and he’s very active in the community. Since a lot of what we do is client education, he’s a perfect fit. The securities licensing is not easy, but a person can study hard and get it if they’re interested. Then we can teach them our own approach to planning and investing, which is again, to act as consultants for our clients. If an adviser can relate to clients on a personal level, helping them understand complicated concepts, and they’re actually interested in our industry, they can learn all the basic nuts and bolts.

Dougherty: I prefer attitude. You can teach the aptitude. When I started the business, they said you had to have the mind of an economist and the heart of a social worker. It’s true.

Excerpts by Web Editor Geoff Pickle, gpickle@sbj.net.

Construction professionals are transforming the landscape – here’s a glimpse of their work in progress.

Delta Roofing founder dies at 85

Cox College switching leaders ahead of Alliance for Healthcare Education transition

Curb Appeal: 23 high-end homes hit market

'Civil War' opens at No. 1 at domestic box office

Four arrested over theft of $300K in Lego kits