YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Just as banks experienced waves of applications this spring from the U.S. Small Business Administration’s Paycheck Protection Program, the federal loan forgiveness process is starting to pick up speed of its own, according to banking officials.

Nationwide, 5.2 million PPP loans totaling $525 billion were distributed. Of that, roughly 4.5 million were for amounts of $150,000 or less, according to SBA data. In Missouri, around $9.2 billion was issued through 91,500 loans.

There were only a handful of PPP loans processed by Legacy Bank & Trust Co. forgiven by SBA in October, but this month has been a different story, said Scott Tennison, senior vice president and director of guaranteed lending.

“November has been a big month for forgiveness,” he said. “We’ve seen some big days, as far as anywhere from 20 to 25 loans a day being forgiven by SBA.”

Tennison said Legacy Bank approved close to 600 PPP loans at a value of $70 million. Roughly a quarter of them, totaling $11 million, have been forgiven as of mid-November, he said.

“They vary in all sizes. I can’t really say they’re picking the small ones because we have some larger ones here recently forgiven,” he said, noting about 75% of the bank’s PPP loan amounts were $50,000 or less.

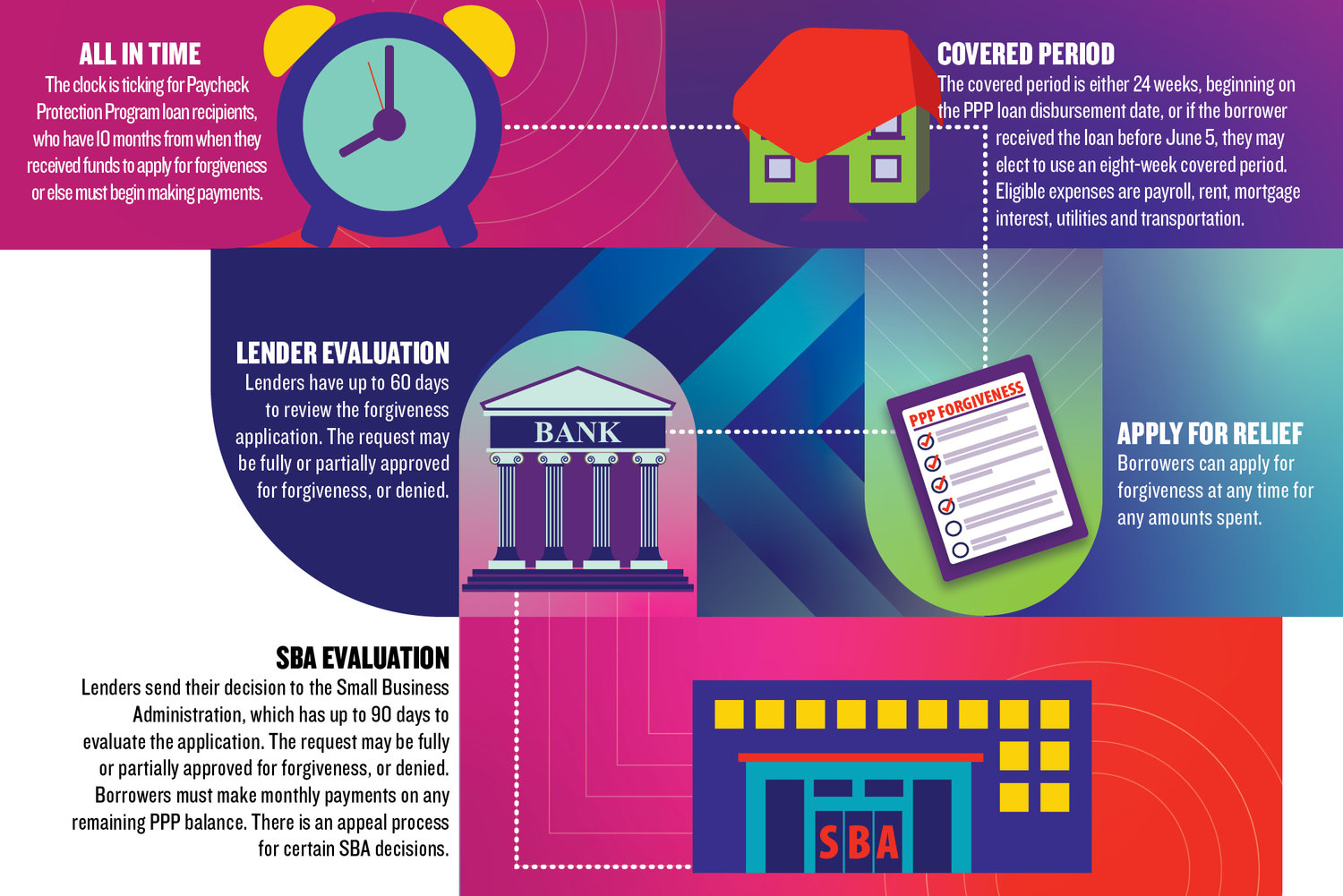

In early October, the SBA began approving PPP forgiveness applications and sending forgiveness payments. Loan recipients have 10 months from when they received PPP funds to apply for forgiveness, according to SBA guidance. If the loans aren’t forgiven, borrowers have to repay their bank with 1% interest assessed. Eligible expenses for the loans are payroll, rent, mortgage interest, utilities and transportation.

Lenders have 60 days to submit applications to the SBA once they receive them from customers. SBA then has 90 days to make a final decision and send funds to the bank.

Given the PPP loan application deadline was Aug. 8, Tennison said some borrowers could still be using funds into early next year. As a result, SBA could still be ruling on forgiveness applications into 2022.

Tennison said the trio of applications is available for borrowers, with the newest, Form 3508S, released in October by SBA in an attempt to reduce the documentation burden for businesses and reviewers. It doesn’t require as much information, such as forgiveness amount calculations. However, all forms require various amounts of documentation, he said.

A higher cap

While the forgiveness process for loans of $50,000 or less has been simplified and expedited, the banking industry doesn’t believe the cap is high enough.

“We would still like to see that increased up to $150,000,” said Max Cook, Missouri Bankers Association president and CEO. “That would add another 900,000 borrowers or so to the total.”

Getting to that $150,000 loan level is a challenge in the current political environment, he said.

“It will all be tied to another stimulus package getting passed,” Cook said, noting Congress is now in a lame-duck period. “It will require legislative action to make that happen, not administrative.”

Republican and Democratic leaders are still trying to strike a stimulus relief deal before the Jan. 20 inauguration of President-elect Joe Biden. However, disagreements continue over the size of the package and whether it includes a second round of stimulus checks for eligible Americans.

“There’s a big, big difference of opinion there,” Cook said, adding he’s skeptical a deal can be reached before year’s end.

In progress

Amy Unser, vice president of loan administration at Central Bank of the Ozarks, said rollout of the forgiveness application process has been understandably slow based on the sheer volume of PPP loans in the system.

“It’s a work in progress,” she said. “We’re still waiting on some guidance from SBA as far as clarification on some of the rules and regulations, and requirements on documentation.”

Lenders and SBA officials are reviewing, in part, the borrower’s calculations and supporting documents concerning amounts eligible for loan forgiveness, according to the SBA. Applications also are being reviewed for the possibility of fraud.

As of mid-November, Central Bank had processed roughly a dozen forgiveness applications, and the SBA approved all of them. There’s a lot more to go for the bank, as Unser said it approved 1,266 PPP loans totaling $111 million.

“We have about 200 applications in at the moment and we’re actively working on them as we can,” she said. “There’s a lot of documentation that goes with it.”

One of those applications is from Evangel University, which received a PPP loan of $3.7 million, said Linda Allen, the school’s vice president of business and finance. Its loan was used entirely for payroll, she said, allowing the university to prevent job cuts or furloughs.

Allen said she filled out a five-page application that required a lot of supporting payroll documentation. The school’s payroll processor, Automatic Data Processing Inc. (Nasdaq: ADP), provided guidance, which she said greatly simplified the workload.

Legacy Bank’s Tennison said SBA’s more streamlined one-page application released last month is currently only available for borrowers with loans of $50,000 or less.

The new application contributed to confusion among some of Central Bank’s borrowers, Unser said.

“This most recent form that came out, when it was promoted, a lot of people out there thought all they had to do was fill out the form and send it in,” she said. “We’ve had to do some education with borrowers on that as we do still need some documentation from them.”

Long road

Unser said the bank is stressing patience to its customers.

“It’s going to be a long process,” she said. “One of the things that we’re relaying to our borrowers is the timeline on these is pretty lengthy.”

Allen said she heard that message but was determined to complete and submit the application as soon as possible.

“It was one of those things where we looked at the calendar and wanted to get it done, sooner rather than later,” she said. “With the holidays coming, some of these things we have to get off our plate.”

While banks have up to two months to review applications before sending them to the SBA, Tennison said Legacy Bank has been able to turn most around in a week or so. No new staff has been needed to take on the extra work.

“At this point, we’ve been pretty efficient with processing them,” he said, noting that was a primary goal when applications started to slowly arrive in August. “We didn’t want them all to come in all at once. We wanted to be able to handle them at a reasonable pace.”

However, that doesn’t mean borrowers are going to receive quick decisions on loan forgiveness, he said.

“They are using just about every bit of their 90 days,” Tennison said of SBA. “It’s taking anywhere from 60 to 90 days.”

Banking officials expect forgiveness applications to be rolling in at a greater pace as 2021 arrives and more businesses close in on the 10-month deadline.

“Probably after the first of the year, we’re going to see quite a few of them,” Tennison said.

Unser, who is in charge of Central Bank’s loan review department, said she has eight people working on incoming applications. She’s confident the bank can keep up with the anticipated increase in application processing.

“I don’t see it slowing down,” she said. “It’s definitely adding to the workload, but we’ll have the ability to get it done.”

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.