YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Last edited 12:45 p.m., Dec. 19, 2019

Missouri voters did more than legalize medical marijuana when Amendment 2 passed; they also put a target on the state.

Veteran marijuana business owners – both medical and recreational – from across the country are looking to expand their reach to the Show-Me State. And some are confident they’ll beat out local entrepreneurs with little experience in the marijuana industry.

Paula Givens, director of compliance and in-house counsel for Happy Days LLC, co-owns four medical marijuana operations in Oklahoma, including a dispensary called ElectraLeaf, as well as manufacturing and cultivation facilities.

“We have an advantage over people who haven’t been in the industry before. There will be less for us to figure out,” said Givens, who also has practiced as a medical marijuana compliance attorney in Michigan and Missouri since 2014 and was an attorney for the National Labor Relations Board for over 20 years.

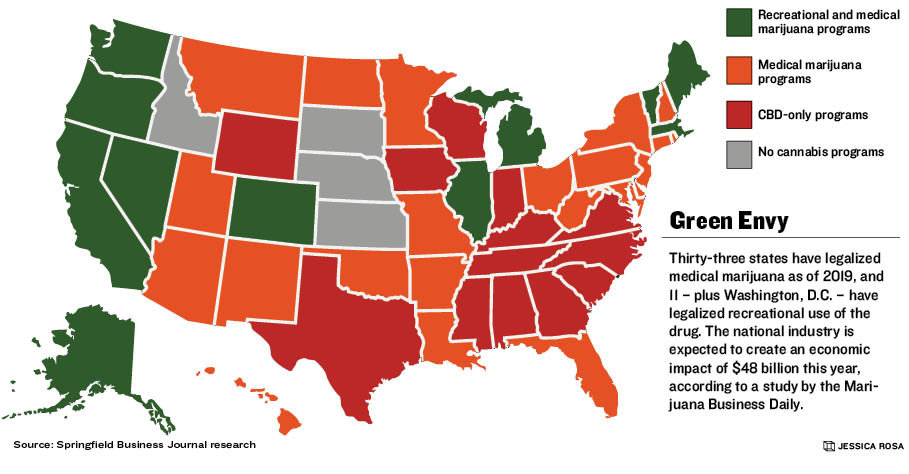

The green envy is growing across the United States as more state legislatures roll out marijuana programs. Thirty-three states have legalized medical marijuana, and 11 plus Washington, D.C., have gone a step further to legalize recreational, or “adult-use” marijuana, according to data from the National Cannabis Industry Association.

Thirteen states – including Texas, Alabama and Tennessee – haven’t gone so far as to legalize medical marijuana but have allowed CBD, or cannabidiol, with restrictions. Only four states – Kansas, South Dakota, Nebraska and Idaho – do not have a cannabis program of some kind, according to data from the NCIA.

Marijuana entrepreneurs from Montana, Oklahoma, Colorado and California are looking to jump headfirst into Missouri’s burgeoning industry.

“It’s largely because it’s a brand-new industry and there’s a lot of opportunity there. It’s a populous Midwestern state,” said Morgan Fox, spokesman for the NCIA. “Missouri is definitely among the rank as a new state to open up an effective medical program.”

Market entry

The out-of-state entrepreneurs are among 2,163 applications for dispensary, cultivation or infused-product manufacturing licenses the Missouri Department of Health and Senior Services received by the end of August. By year’s end, the state will grant licenses to a maximum 24 dispensaries in each congressional district and 60 cultivators and 86 manufacturers statewide.

Givens, originally from St. Louis, is hoping to open an infused product manufacturing plant in Springfield, at 2900 E. Pythian St., with an investment of at least $1 million.

Givens is also a minority owner and in-house counsel of a vertically integrated operation called Certified Alternative Medicine Providers LLC, which would partner with Happy Days to distribute products. CAMP’s nearest location would be in Lebanon, if approved.

“We hope to have our manufactured products in as many dispensaries as possible,” Givens said.

In Oklahoma, Givens said ElectraLeaf is selling 20,000 units of infused gummies per month. Givens said it’s hard to know how much Happy Days will produce in Missouri because it depends on how much source material the company will be able to obtain from cultivation centers.

Givens said that with more manufacturing licenses than cultivation licenses expected to be awarded in the state, there will likely be a shortage in product for manufacturers, such as the cannabis trim that manufacturers use to make oils.

It’s also too soon to know what the demand will look like in Missouri, Givens said, adding, “It’ll take a minute here for the patient number to ramp up.”

As of Oct. 2, over 14,700 Missourians had applied for a medical marijuana card, and over 12,700 were approved, according to data provided by the state health department.

Top Shelf Botanicals LLC, based in Montana and Oklahoma, also applied for one cultivation, five dispensary and two infused-product manufacturing licenses in the state. Springfield is one of the company’s targeted dispensary locations.

Wes Stucki, CEO of Top Shelf Botanicals, is a Missouri native who got into Montana’s medical marijuana industry in 2017. He now has nine dispensary locations in the state. Stucki expanded cultivation services to Oklahoma when the state began its medical marijuana program last year. For 15 years before joining the industry, Stucki was CEO of American HealthChoice Inc.

Stucki said Top Shelf Botanicals is vertically integrated and with state approval would operate a cultivation and infused-product manufacturing facility in Conway. Stucki said he’s confident the state will grant Top Shelf the licenses.

“We have the proper platform. We have the finances for it, the management team for it and the know-how,” Stucki said.

He said it costs nearly $2 million to create a cultivation facility, plus another $300,000-$400,000 for manufacturing equipment. The company’s Conway building is 33,000 square feet on a 50-acre lot with room to expand, he said.

The company has set aside $5 million for its business plan, Stucki said, and it has access to $10 million more for possible mergers or additional dispensaries down the road.

Billions in the waiting

What will the economic impact of medical marijuana be in Missouri?

It’s not clear how much the U.S. medical and recreational marijuana markets are worth as black-market sales remain an unknown factor. But medical and recreational marijuana retail sales are on pace to reach $12 billion this year with a nearly $48 billion economic impact, according to a quarterly update on marijuana market data compiled by the Marijuana Business Daily. This includes several factors, like launching a new business, real estate investment, state and local taxes, and tourism.

In a marijuana market study conducted for the Missouri Department of Health and Senior Services, related state tax collections are projected to tally $1.6 million in 2020 and nearly $2.9 million in 2021.

Nationally, the industry is a green giant. It’s expected to result in $100 billion in economic benefits by 2023 – based on a multiplier of 3.5 of annual marijuana product sales, according to the Marijuana Business Daily study. That’s more than the first quarter 2019 gross domestic product of 13 states, according to Bureau of Economic Analysis data and Springfield Business Journal research.

In Pueblo County, Colorado, the marijuana industry generated $35 million in positive net impact and $58 million in economic benefits in 2016, according to a report released by Colorado State University-Pueblo. Researchers found the net growth in the county could reach nearly $100 million a year by 2021.

Apothecary Farms – a Colorado-based, vertically integrated company operating in Pueblo – also has its sights set on Missouri.

“We feel like those are our people. We’re not trying to go and figure things out in California, Seattle or Portland,” said Marshall Marquardt, chief operations officer of Apothecary Farms. “We’re staying true to what we feel like is a great operational platform for our company.”

The company applied for 11 licenses in Missouri under MOAF LLC, which stands for Missouri Apothecary Farms. If all are approved, Marquardt expects to spend $750,000 per location and a total of over $7 million in buildout. He expects each facility to earn at least $1 million in revenue in the first year.

Marquardt said the company, which is used to being surrounded by hundreds of dispensaries in Colorado, appreciates Missouri’s regulatory approach. “They’re being very cautious in terms of opening the floodgates,” he said of the state program. “With just the application itself, it’s going to be a difficult game to get into.”

Moseley’s Discount Office Products was purchased; Side Chick opened in Branson; and the Springfield franchise store of NoBaked Cookie Dough changed ownership.