YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

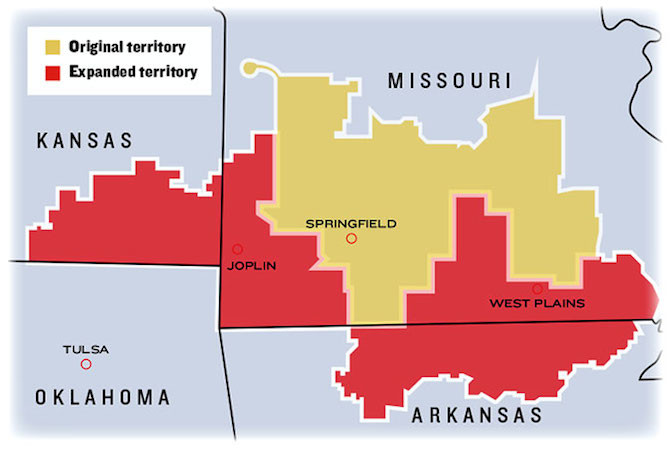

In a deal finalized over the last six months, Ozarks Coca-Cola/Dr Pepper Bottling Co. expanded its franchise footprint on Oct. 30 through a purchase of new territories and distribution centers from Atlanta-based The Coca-Cola Co. (NYSE: KO).

Ozarks Coca-Cola Vice President of Corporate Strategy Sally Hargis said the moves grow the scope of the 95-year-old, family-owned independent bottling company’s business by 60 percent. Terms of the deal were undisclosed.

“Our interest certainly was to be able to grow the company, and it was a very good opportunity for us to do that,” Hargis said, noting Ozarks Coca-Cola’s active pursuit of franchise expansion since 2012 culminated with the company signing a letter of intent with the global beverage maker in April.

With the inked deal comes a significant boost to the company’s human resources, adding 160 new employees – a roughly 53 percent increase – to an existing base of 300. The potential population served in the new area grows to 1.36 million, based on Hargis’ estimate, from 850,000 under the previous territorial boundaries.

Of 68 independent bottlers, Hargis said Ozarks Coca-Cola is one of nine that participated in the first phase of the Atlanta company’s refranchising strategy launched in 2013.

Referred to as the 21st Century Beverage Partnership Model, Coca-Cola North America spokesman Scott Williamson said via email the multiyear plan would refranchise the majority of the company’s North American bottling network by 2017 through granting exclusive territory rights and the sale of distribution assets and equipment through the company’s wholly owned subsidiary Coca-Cola Refreshments USA Inc.

“The Coca-Cola Co. and our bottling partners will continually evolve our franchise model to meet the needs of customers and consumers, and ensure our system is best positioned to deliver sustainable, profitable growth,“ Williamson said, adding the intended benefits of the program are to produce more contiguous operating territories and an improved and integrated information technology platform. “We believe these changes will create a more contemporary, agile and customer-focused operating model.”

As it works to shift the corporate-owned territories operated by the subsidiary to franchisees around the country, Coca-Cola Refreshments still held 70 percent of case volume distribution, as of September.

Hargis said expansion moves by others – particularly those by a franchisee in the Chicago area and a newcomer to the central Florida market – knocked Ozarks Coca-Cola out of its coveted place among Coca-Cola Co.’s list of the top 10 independent bottlers by percentage of case volume.

“As territories change hands over the past and future months, rankings change,” Williamson said. “Essentially, (Ozarks Coca-Cola is) one of the larger bottlers around the top 10.”

The acquisition of the two distribution centers in Joplin and West Plains, previously operated by the Coca-Cola Refreshments subsidiary, adds to Ozarks Coca-Cola’s stable of divisions already established in Springfield, Bolivar, Lebanon and Rolla. It also doubles the number of counties served to 69 and brings business across state lines into Arkansas and Kansas.

“That’s entirely new to us,” Hargis said.

The moves create some challenges in the next phase.

For example, a soft drink tax in Arkansas levies 21 cents per gallon of bottled, canned or powdered drinks and $2 per gallon of soft drink syrups.

“There is a little bit more learning to do about both states and how they are going to differ from Missouri,” she said.

One operational difference is a more rural customer base.

“We’re going to take an in-depth look at all the routes that run out of those distribution centers and see if we can’t improve delivery frequency and customer service so that we can improve the profitability of the two areas,” Hargis said.

Two weeks after both locations started rolling out product under Ozark Coca-Cola’s ownership, Hargis said the company doesn’t have any immediate plans for plant or warehouse expansions. Management, however, is analyzing capital investments for the two new centers – a requirement for being granted additional territories.

“We might need new delivery trucks in the Joplin area, and we might need more cold drink equipment in West Plains,” Hargis said, noting the Joplin center was recently rebuilt following its destruction in the May 2011 tornado and likely won’t require further improvement. “It kind of depends on the condition of each market, which we’re just now examining.”

Missouri State University’s science building, built in 1971 and formerly called Temple Hall, is being reconstructed and updated.