YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

The June 5 announcement of the national unemployment rate falling to 13.3% in May provided an unexpected shot in the arm for the stock market.

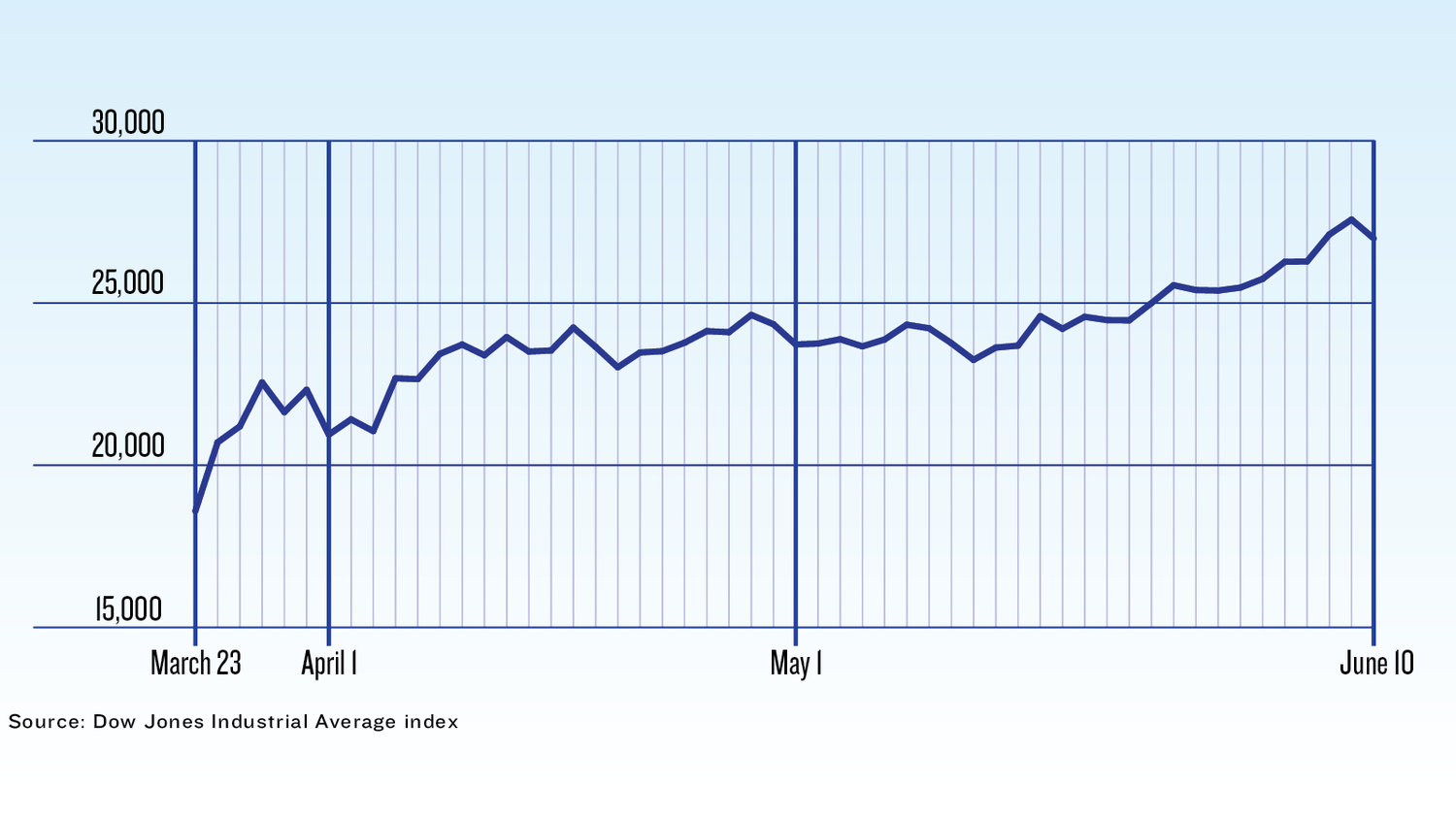

According to the U.S. Bureau of Labor Statistics, 2.5 million jobs were added to the economy, the largest monthly increase since at least 1939. In response, the Dow Jones Industrial Average exceeded 27,000 points for the first time since early March.

“It surprised most everybody, including me, which is why I don’t forecast,” said Steve Mullins, professor of economics at Drury University. “All forecasters and every economist I know thought we were going to see another month of job losses and the unemployment rate getting as high as 20%.”

Mullins said that doesn’t mean the economy has turned a corner, as there’s still tens of millions without jobs in the country. More than 44 million have filed initial unemployment claims over the past three months, according to the Labor Department.

But the recent Dow jump – nearly 1,000 points on June 5 from June 4 – is the latest in a series of rises for the stock market.

As the coronavirus pandemic impact began to be widely felt in the United States in March, the market was reeling. The Dow crashed March 23 to 18,591 points.

But it’s been a consistent incline for the market since then. On June 8, the Dow finished at 27,572, reducing its 2020 losses to 3.3%. That’s a rebound of roughly 48% from its March low.

“Whether or not it’s going to be sustainable is really hard to say because I just don’t know if anyone knows for sure how the pandemic is going to pan out,” Mullins said. “The market clearly is betting that the pandemic is not going to be as bad in the future as everyone initially kind of thought.”

Taking advice

Ken Homan, senior vice president and senior portfolio manager at Central Trust Co., said he was proactive in March and anticipated clients would be nervous when the virus arrived. But he said their concerns turned out to be more for physical health rather than financial.

Homan said clients took his advice to not panic about the stock market drop and stood pat with their investment portfolio.

“The market doesn’t like uncertainties, and we had more uncertainties than ever,” he said. “There was room for angst about what lay ahead in the equity markets, particularly.”

However, the stock market should be viewed as a long-term investment, said Joe Froehle, managing director of investments with Wells Fargo Advisors LLC. It’s important to have a plan for long-term assets to withstand market volatility – even when it’s a worldwide pandemic, he said.

“If your plan is in place where you’re not in a position to have to sell stocks when they are down, then you can afford to stay the course if there is a major shock to the stock market like we experienced in March,” he said, noting the Dow’s 20% drop from its February high took it into a bear market. “For most investors, when you see the stock market drop as quickly and as large a magnitude as the drop was in March, it’s human nature to get worried and get concerned, and, in some cases, reach panic.”

Focusing on the long term and not acting on emotion is the most profitable strategy, Froehle said, adding sometimes the most important course of action is to not change anything in a portfolio.

“Investment in the equity market is paying for risk,” Homan said. “The risk is that you have to weather the storms of volatility like we’ve seen here.”

Back to work

The market’s fall was in response to economic shutdowns, which caused a heavy shedding of U.S. jobs, Froehle said. Jobs will return, but no one knows how many and how soon.

“In the absence of further widespread economic shutdowns, the U.S. economy is poised to make a comeback over the next year,” he said. “The recent stock market rally is reflecting that.”

While the federal coronavirus relief act included a provision of an additional $600 per week for the unemployed, it’s set to expire at the end of July. Mullins said the loss of the benefit might be a help and a hindrance for the economy.

He said it’s a loss of discretionary income for those who are jobless and could lead to further depression of consumer spending. But it also could incentivize people to get back into the workforce who have been making more with the federal unemployment supplement than when they were working full time.

“When that goes away, it’s going to put pressure on people who aren’t seriously considering going back to work,” Mullins said. “That can be a positive thing.”

Short-term economic forecasts are difficult to rely on, Mullins said. But he said those who trade stocks and bonds believe a recovery will be relatively quick.

“It depends to a large degree on what kind of flare-ups we see in the pandemic later on this summer,” he said. “We’ll see the results of the protest movement that has had a lot of people in close proximity. It’s going to take a few weeks to find out the full extent of what the opening up of different states is going to do to the contagion.”

If COVID-19 infection numbers start to significantly rise again, Mullins said locking down the economy could be on the table, possibly reversing the positive trend reflected in May’s unemployment numbers.

Froehle said the market hasn’t had a major pullback since March 23, but he wouldn’t be surprised if one happens in the next year. That depends on the success of jobs returning and no more major interruptions, such as stay-at-home orders.

Still, he and Homan remain bullish on the stock market’s long-term prospects.

“It always pays to be a little optimistic. You can’t get caught up in negativity as an investor,” Homan said. “That’s a rule of thumb here and that will generally always apply.”

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization

Survey finds increase in average salary Americans willing to take