YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Finishing off 2018 with an acquisition of Pompano Beach, Florida-based Bennett Auto Supply, O’Reilly Automotive Inc. (Nasdaq: ORLY) is poised to hit a landmark high in sales for 2019.

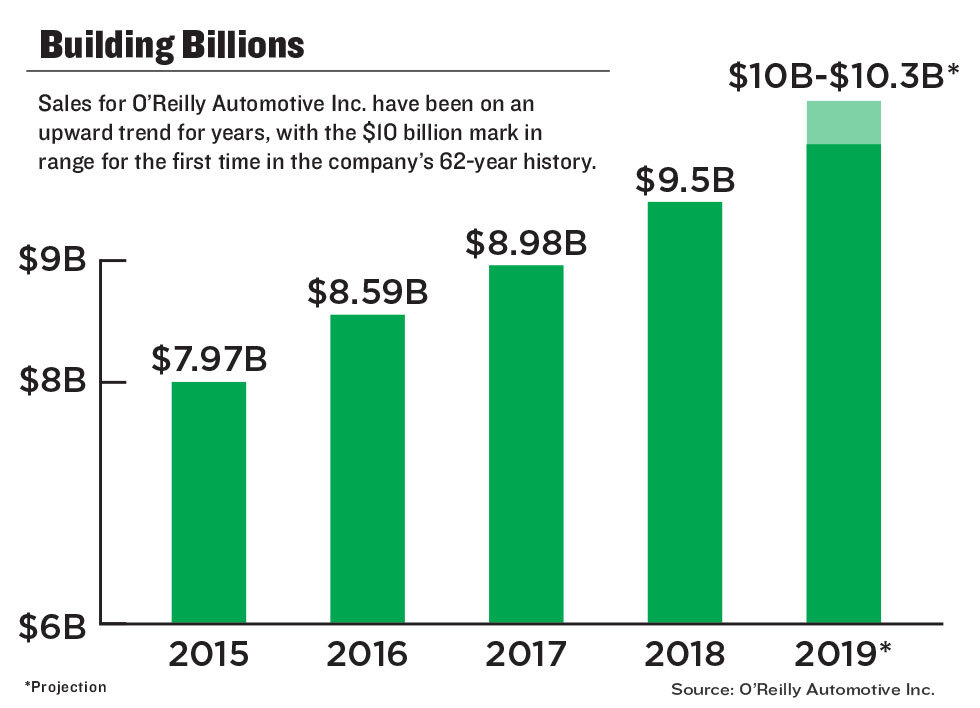

Mark Merz, vice president of investor relations for O’Reilly Automotive, said the Springfield-based company’s top line revenue this year is expected in the $10 billion-$10.3 billion range. Sales in 2018 grew 6.2 percent to $9.5 billion.

“We’ve achieved record revenue growth every year since we’ve been a public company,” Merz said, noting O’Reilly Automotive went public in April 1993. “But this would be the first time we would have achieved $10 billion in sales in a given year, which is a very big accomplishment for the company.”

The auto parts retailer posted 2018 earnings of $1.3 billion, up 17 percent from $1.1 billion in 2017. Diluted share earnings rose to $16.10 from $12.67 per share a year earlier, Merz said, adding the original earnings per share guidance at the start of 2018 was $15.10-$15.20.

Wall Street responded favorably. In the days following its full-year and fourth-quarter earnings report released Feb. 6, the ORLY stock climbed to a series of five new highs, arriving at a 52-week and all-time high of $394.42 per share on Feb. 19. The share price increased nearly 10 percent in that span, before closing Feb. 27 at $378.28. Its 52-week low is $217.64.

Merz said O’Reilly Automotive’s growth was driven in part by its operating performance exceeding its original guidance for the year. The EPS guidance for 2019 is $17.37-$17.47, while comparable store sales rose by 3.8 percent in 2018, above the 1.4 percent increase in 2017, he added.

The company met its goal of opening 200 net, new stores in 2018. By year’s end, O’Reilly operated 5,219 stores in 47 states, not counting the 33 stores newly acquired from Bennett Auto.

“We think we have the ability to open around 200 stores per year into the foreseeable future,” Merz said. “That’s right in line with our expectations.”

O’Reilly’s acquisition of Bennett closed after Dec. 31, 2018, for an undisclosed amount, Merz said, with plans to convert the Florida company’s stores to O’Reilly Auto Parts shops in the first half of the year.

O’Reilly is now second in number of stores among auto parts retailers nationwide, trailing the 6,218 stores of Memphis, Tennessee-based AutoZone Inc. (NYSE: AZO). At a close third is Raleigh, North Carolina-based Advance Auto Parts (NYSE: AAP), with its 5,109 branded stores at the end of 2018.

Sales for AutoZone ended 2018 at $11.2 billion, while Advance Auto Parts hit $9.6 billion, according to company full-year reports to the Securities and Exchange Commission.

Carolyn Hoffman, executive vice president at SignalPoint Asset Management LLC, has followed O’Reilly stock for 20 years as a financial adviser. She said O’Reilly has established a good operating environment and is benefitting from solid economic conditions, such as low unemployment that spurs people to spend more on bigger purchases such as new cars. According to media reports on the U.S. automaker industry, sales of new vehicles rose slightly in 2018, to 17.27 million, up 0.3 percent from a year prior.

“The only risk I see at investing in it is the price that you buy the stock,” Hoffman said, noting, however, investors shouldn’t get too fixated on any one company. “People can get very overloaded in one stock, so it’s important to diversify.”

Hoffman said O’Reilly also has a share repurchase program that enhances the value of the stock by buying shares and retiring them. This increases the shares’ value on the market and the shareholder’s percentage of company ownership.

According to its full-year report to the SEC released last month, O’Reilly repurchased 1.4 million shares of its common stock during the fourth quarter of 2018, at an average stock price per share of $338.92, for a total investment of $463 million. For the year, 6.1 million shares of its common stock were repurchased by the company at an average price per share of $282.80, for a total investment of $1.71 billion.

Merz noted the company’s board approved the share repurchase program in 2011.

“Our first and best use of capital is to reinvest in the company to continue our profitable growth. If we generate capital in excess of what we can profitably reinvest in the business, that capital belongs to the shareholders,” he said, adding the goal of the program is to use excess capital to return to the shareholders to lower the outstanding share count.

Shares outstanding were at 80.1 millionv as of Feb. 28, according to Nasdaq, while O’Reilly reported 84.3 million outstanding shares as of the end of 2017.

Noting the company last split its stock in 2005, Merz said the stock market has “significantly changed since that time,” making such an action in the future “very unlikely.”

“With the advancement of electronic trading and the ability to buy partial shares, there’s really no longer the barrier for anybody to invest in any company,” he said.

Hoffman agreed that the ability to buy as little as one share of something and not be penalized makes splitting stocks a strategy she highly doubts would be employed by O’Reilly.

“You don’t see that anymore from hardly any companies,” she said. “The main reason is the cost of trading has come down so much.”