YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

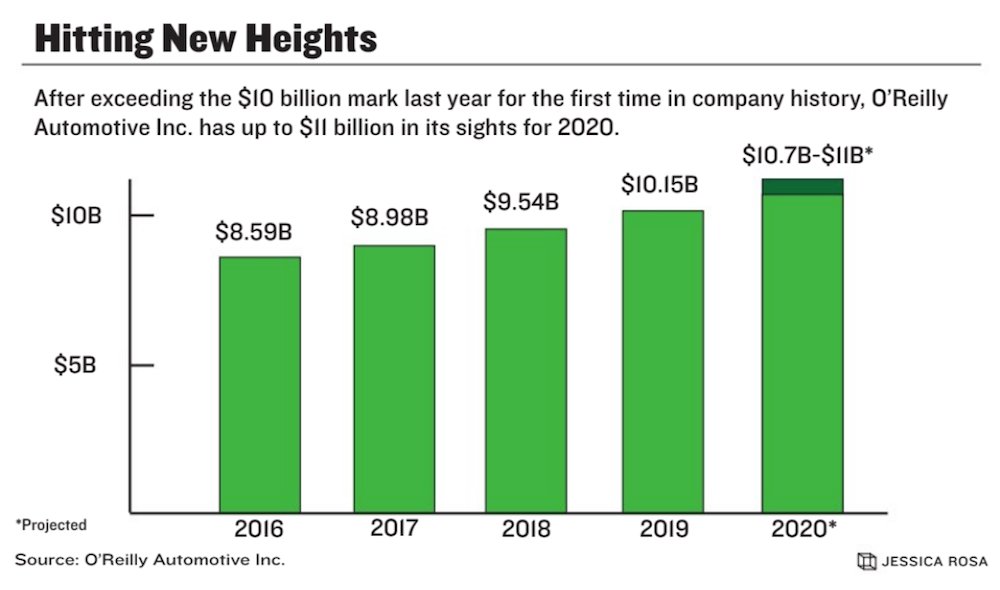

The decade’s end was significant for O’Reilly Automotive Inc. (Nasdaq: ORLY), as the auto parts retailer exceeded $10 billion in annual sales for the first time in its 63-year history.

The Springfield-based company finished 2019 with $10.15 billion in sales, a 6.4% increase from 2018’s $9.54 billion. Its top-line revenue kept with projections noted by company officials last year, said Mark Merz, vice president of investor relations for O’Reilly Automotive.

“It is a very significant milestone,” Merz said, noting co-President and CEO Greg Johnson congratulated employees at the company’s annual leadership conference in January. “We had a real solid year in 2019. We hit, for the most part, the midpoints of all of our guidance ranges that we provided at the beginning of the year.”

Earnings in 2019 reached $1.4 billion, up 5% from $1.3 billion in 2018. Comparable store sales increased 4%, against 3.8% in 2018.

In O’Reilly’s full-year and fourth-quarter earnings report released Feb. 5, Johnson noted 2019 was the 11th straight year for the company to have 10% growth or more in diluted earnings per share. Diluted share earnings increased to $17.88 from $16.10 in 2018, an 11% bump. For 2020, EPS guidance is $19.03-$19.13. Officials credit sales growth on the company’s customer service focus as well as through its expanding store count.

Sales growth is expected to continue for 2020, Merz said, with the company expected to land in the $10.7 billion-$11 billion range. He said year-over-year sales projections are a little higher than the growth rate of the past several years. The rate has been between 4.5% and 6.4% since 2016. If $11 billion is reached, it would equate to an 8.4% increase over 2019.

International interest

Merz pointed to O’Reilly’s first expansion outside of the United States in November as a contributor to the higher guidance range in sales. In November, the company closed on its acquisition of Guadalajara-based Mayoreo de Autopartes y Aceites S.A. de C.V., dba Mayasa. The Mexican company sells automotive aftermarket supplies, with 21 stores and six distribution centers in its portfolio, Merz said.

“We’ll have a full year’s worth of those operations in our results, so that drives growth above what we’ve seen in the last couple of years, on a year-over-year basis,” he said.

An international presence has been on O’Reilly’s long-term strategic map for years.

The addition of more than 1,100 employees at Mayasa bolstered O’Reilly’s employee count by the end of December to 81,233, up nearly 3% for the year, according to the annual earnings report. The retailer will have various teams working this year to learn Mayasa operations, Merz said, including how to interact with customers and team members in Mexico, and untapped markets in the country. As a result, he said guidance is for 180 new O’Reilly stores in 2020. That’s down from roughly 230 gained in 2019, as O’Reilly finished the year with a store count of 5,460.

“We’ll be spending a lot of time evaluating our operations in Mexico,” he said. “So that’s going to pull some time away from those teams and what they would be doing here in the U.S.”

The company has interest in pursuing additional growth opportunities in Mexico, as well as Canada and the Caribbean, Merz said.

“We also think we have a lot of growth left in the U.S.,” he added, noting the company has yet to enter Delaware, Maryland, New Jersey and the District of Columbia.

Taking stock

While the annual earnings report revealed a number of growth areas for the company, it wasn’t enough to prevent a dip in the ORLY stock. Shares opened Feb. 5, the day of the report, at $419.21, but dropped to $398.13 the next day. Shares closed Feb. 13, just before press time, at $392.56 and have posted a 52-week range of $349.71 to $454.31.

Despite the price drop, ORLY is still a stock worth owning, said Brian Yarbrough, consumer research analyst with Edward Jones. The St. Louis-based financial services firm is Morgan Stanley, Raymond James and William Blair recommending buying the auto parts retailer’s stock, according to Nasdaq.

Yarbrough said the post-report stock price dip isn’t a big deal, but noted the company’s expenses ran a little higher than expected in the fourth quarter, which impacted the profit margin. O’Reilly’s Johnson said in the report an unexpected surge in health benefit costs caused the operating profit to fall short of company expectations.

Still, Yarbrough said the company stock has been a strong performer in recent years and sales came in better than projected.

“They’ve been such good operators and they’ve proven to rebound well,” he said, pointing to the entry into Mexico. “It’s the right move and longer term is a good growth opportunity.”

Merz said the company doesn’t make moves based on how it might be perceived on Wall Street.

“We don’t control our stock price,” he said. “We control our operations and that’s what we focus on. Our focus is to drive operating profit dollar growth and provide a great return for our shareholders.”

Web Editor Geoff Pickle contributed.

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization