YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

As a roughly 130-year-old company, The Bank of Missouri seeks to be intentional about amplifying its history while keeping the pulse of current and future trends.

“We have a side that looks to the history of what we have done as a core bank,” says Tim Scott, the company’s southwest regional president. “A lot of that happened by adding on a branch here and adding on a branch there.”

Along with offering new services such as credit card processing through the years, the bank has sought strategic opportunities.

One such opportunity came in early 2020, when an acquisition was a game changer for The Bank of Missouri, Scott says.

That year, Perryville-based Reliable Community Bancshares Inc., The Bank of Missouri’s parent company, finalized its acquisition of Bank of Bolivar operator Bolivar Bancshares Inc.

“That was probably the needle-mover that I would say is the most recent,” Smith says, noting the acquisition cost was roughly $300 million to $350 million.

With the acquisition, The Bank of Missouri assumed Bank of Bolivar’s $300 million in assets and six branches, including two in Springfield.

Another opportunity for growth came during the pandemic, when the bank signed on to assist businesses through the federal Paycheck Protection Program.

“Not all of the big banks, even the banks in this area, offered the PPP. Some of them didn’t know how to handle it and they didn’t know how to staff it,” Scott says. “We did everything in our power to be able to be the answer on PPP.”

It was a strategy that paid off.

“We thought this was the opportunity to really shine as a community bank. We were able to pick up a lot of customers and profitable relationships,” Scott says.

Moving out of the pandemic, Scott says higher interest rates is one issue impacting the banking industry.

For The Bank of Missouri, an interesting trend has emerged.

“Even as inflation rises, we still see a lot of money sitting in the banks. It’s helped us have a lot of liquidity,” he says. “We’ve been able to keep our interest rates at a very attractive level because our costs of funds are low.”

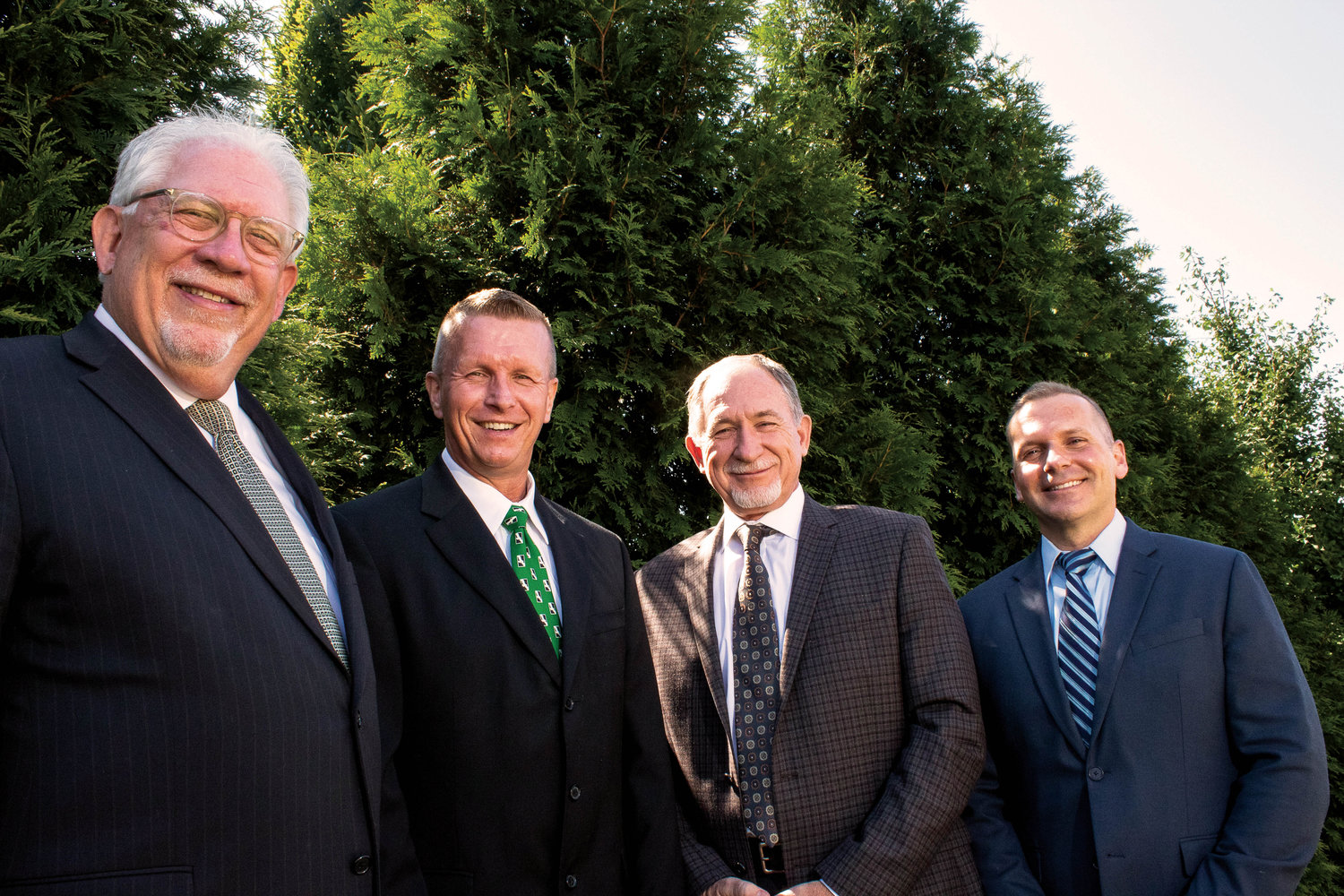

Scott says banking is about relationships, and recent leadership transitions will help in that aspect of the company’s operations.

Tony Lewis, a Queen City native who played baseball professionally before starting his banking career around 12 years ago, recently was hired as The Bank of Missouri’s Springfield community bank president. He succeeds David Cook, who in now vice chair of the company’s southwest region.

The Bank of Missouri ranked No. 8 on Springfield Business Journal’s 2021 list of the area’s largest banks and savings banks. The ranking is based off Federal Deposit Insurance Corp. data showing the company had $573.2 million in Springfield metro area deposits as of June 30, 2021, or 3.92% of the market share.

Cedars Family Restaurant has cooked up comfort for over three decades.

Aquatic center fronting Sports Town in the works

Spring 2024 Construction in the Ozarks

SPD issues 36 citations to businesses for violating city’s gaming machine ban

Lost & Found Grief Center hires executive director

Nixa spokesperson takes job with city of Joplin