YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

The Missouri Chamber of Commerce and Industry is offering the state’s first-ever self-funded health insurance program, and it’s targeting small businesses.

“It’s for any employer who’s a member of ours, the Missouri chamber or of one of our chamber federations, which, as of my last count, there were 113,” said chamber Chief Operating Officer Brendan Cossette. “Our whole thing is, we talked to our members and we heard over and over, ‘God, our health insurance costs are killing us.’”

Technically, the program is called a multiple employer welfare arrangement, and it’s in partnership with St. Louis-based Anthem Blue Cross and Blue Shield.

Eligible businesses must have between two and 50 employees and operate in Anthem’s service area. Anthem covers 84 out of 114 counties in Missouri, including Greene County, Cossette said.

Cossette said the chamber worked through 18 months of research and planning before the option for small businesses went live Nov. 1. Organizers say there is no set enrollment period in the program, but renewals are scheduled June 1.

Small-business benefits

Organizers say the chamber program allows small businesses to band together to share in a larger claims risk pool.

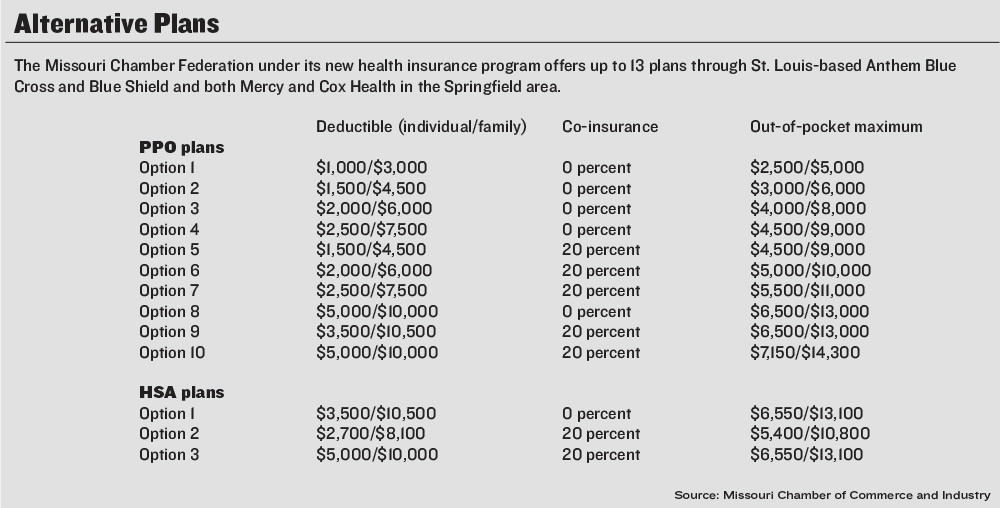

“It has the ability for a lot of employers to provide rates that are lower than the traditional health insurance plans right now under the Affordable Care Act,” Cossette said, adding the program offers a variety of plan designs, including 10 preferred provider organization plans and three health savings account options through both Mercy and CoxHealth in the Springfield area.

Three Springfield-based insurance brokerages – Croley Insurance & Financial Inc., Employee Benefit Design LLC and Ollis/Akers/Arney – were selected by Anthem among 11 statewide to participate in the program. Cossette was unaware whether more brokerages would be added to the mix.

The group insurance plans start with a $1,000 deductible per employee and moves up to a $5,000 deductible.

“Those 10 PPO plans all have office visit co-pays and drug cart benefits, urgent care benefits; they have a full gambit of benefits that are available,” Croley Insurance co-owner Andrea Geyer-Croley said. “They’re all compliant with the Affordable Care Act.”

Then there’s the choice of an HSA plan.

“You might just want lower costs and nothing but preventative services,” Geyer-Croley said, adding HSA rates vary by the size of the group.

About five weeks into the program, Cossette said 38 Missouri businesses have jumped on board.

“We have submitted 30 groups, which is a pretty sizable number,” Geyer-Croley said, declining to disclose the applicant names.

“Most of them are in this area.”

Geyer-Croley said the program could create a healthier small-business community across the state.

“Some of the rural chambers that have never joined the Missouri Chamber Federation are now considering that,” she said. “And I think brokers are also telling their clients this is the only way you can actually get this, and so some of our clients that have never belonged to the chamber are becoming members. It’s a positive thing.”

Role models

The chamber modeled its program after the Southern Ohio Chamber Alliance’s health insurance program, which went live May 1, 2016.

“It’s worked very, very well,” Geyer-Croley said.

Today, the alliance has 785 businesses with 6,800 employees enrolled, the organization’s Executive Director Matt Appenzeller told Springfield Business Journal.

“We’re averaging 8.6 employees per group,” Appenzeller said. “It’s added a whole lot of value to small businesses that they didn’t have before.”

In Missouri, those involved with the program say the chamber is receiving some 60 applications a day from the participating insurance agencies.

“I think that will increase over time as we move forward with the program,” Geyer-Croley said.

Cossette was unable to disclose names of interested employers.

Naj Agnew, general manager for Springfield Brewing Co., said the company, a member of the Springfield Area Chamber of Commerce, employs roughly 20 people who work approximately 30 hours a week. Agnew did not express interest in the chamber’s program. The company is under a pre-ACA group benefits plan.

“Our current rates are very competitive,” Agnew said via email. “Our ownership group has roots in health care and therefore are very particular about providing generous benefits. Our company provides an 80/20 split with our full-time employees that opt for coverage, which is practically unheard of in our industry.”

The problem the chamber is addressing hits close to home for the Jefferson City-based organization.

“Two years ago, our health insurance costs increased 29 percent, and then last year they went up another 35 percent. This year they were going to go up another 35 percent, so in three years that’s a hundred percent increase,” Cossette said. “We joined the MEWA, of course, and it has lowered our rates 11 percent.”

The chamber’s own group plan, covering 25 employees, is very similar to its previous policy, Cossette said.

“We didn’t want it to be about putting folks in a position where they’re losing all their benefits or all their options,” he said.

Connected to Watkins Elementary School is a new storm shelter now under construction.

STL construction firm buys KC company

Updated: Systematic Savings Bank to be acquired in $14M deal

Missouri House speaker accused of obstruction in ethics probe

Webster University's deficit triples

‘Dress for your day’: Companies are relaxing dress codes amid evolving ideas about fashion