YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

In its largest acquisition to date, Arvest Bank on Aug. 22 agreed to purchase Bear State Financial Inc. (Nasdaq: BSF), the parent company of Bear State Bank, for $391 million.

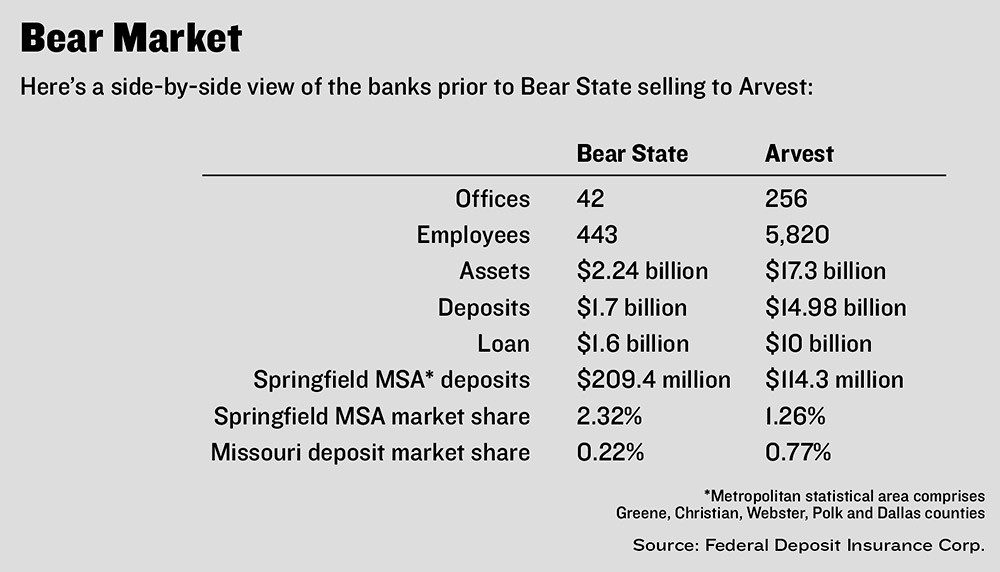

The deal by the two Arkansas-based financial institutions is pending approvals by Bear State shareholders and regulators. It would add 42 branches and three technology centers to Arvest’s mix of 256 branches across Arkansas, Missouri, Oklahoma and Kansas. Arvest operates 12 branches within 50 miles of Springfield.

Officials close to the deal say the Springfield and Little Rock, Arkansas, markets were in demand.

“It is faster to market than this continued, slow-growth progression,” said Arvest-Springfield President and CEO Brad Crain, referencing the bank’s organic growth locally since 2007.

Bear State entered the Springfield market through a $70 million purchase of Metropolitan National Bank in 2015. Bear State operates three banks in the city.

As of June 30, Little Rock-based Bear State had $2.24 billion in assets and $1.7 billion in deposits, while Arvest had $17.3 billion in assets and $14.98 billion in deposits, according to a news release announcing the deal.

“We’ll pick up all the customers and households as part of that,” Crain said.

Crain anticipates the deal to close late this year or early 2018, when Bear State will be renamed and customers will be migrated.

“We will be communicating with them in the coming weeks and months about what that transition will look like and what the timeline will be,” he said.

Market moves

In the Springfield market, the move would nearly double Arvest’s deposit market share across the five-county metropolitan statistical area.

Bear State has a 2.32 percent share of deposits in the Springfield MSA, and Arvest has a 1.26 percent share, according to Federal Deposit Insurance Corp.’s summary of deposits report as of June 30, 2016, the most recent data available. The combined $323.7 million in deposits would send Arvest to the 10th largest from No. 21 out of 39 banks in the MSA comprising Greene, Christian, Webster, Polk and Dallas counties. Arvest would surpass BancorpSouth on the list and close in on Springfield First Community Bank and OakStar Bank.

The publicly traded Bear State will become privately held under Arvest. There are no plans to close any branches at this time, Crain said.

“In some cases, there may be Arvest Bank locations very close to a Bear State location, which may lead to some closures over time,” he said.

Within the 34 communities where Bear State operates, 16 of the markets are new to Arvest.

Bear State President and CEO Matt Machen was unavailable by deadline. Chief Administrative Officer Shelly Loftin responded to interview requests by email: “We believe this merger is in the best interest of all of our shareholders, our customers and our team members.”

The day of the announcement, Bear State’s 37.7 million shares traded at their highest volume of the past year, according to Nasdaq.com, and closed at $10.20 per share – 9 percent higher than the previous close. The stock has a 52-week high of $10.95 a share and a low of $8.65 a share.

Second-quarter earnings for Bear State Financial were $6.7 million, according to the company website, compared with $4.5 million for the same period in 2016. Assets and loans both grew 12 percent over the past year, according to a statement, and deposits grew 4 percent.

Earlier this year, Bear State laid off roughly a dozen employees in the Springfield area, according to Springfield Business Journal reporting. Bank CEO Mark McFatridge, who had led Metropolitan National prior to the sale, left before the layoffs, citing personal reasons.

History of acquisition

Arvest is no stranger to acquisitions. The bank began with the purchase of The Bank of Bentonville by Sam Walton, a year before he opened his first Wal-Mart store, Crain said. Two more banks were bought in the 1960s and ’70s, according to the company website. In the ’80s, it ramped up acquisitions – including its second-largest buyout, Superior Federal for $211 million in 2003 – and by 2006 had more than 200 branches.

Although Arvest spread across the four-state area largely by acquisition, that’s not how it entered the local market, Crain said. Arvest opened a Joplin branch in 1998, followed by its first Springfield presence in 2007.

“We leased a storefront on Bradford Parkway in 2007 and started growing one customer at a time,” he said. “We’ve never acquired any branches in the Springfield metropolitan area.”

The first Springfield office was relocated in 2012 to a stand-alone building on South Fremont Avenue, and three others were added between 2008 and 2012. Other area banks were opened in Hollister and Nixa.

Arvest penetrated rural southwest Missouri through a 2013 purchase of 29 Bank of America branches slated for closure in the communities of Aurora, Lebanon, Mountain Grove, Branson, Branson West and Forsyth.

Most purchases in the last eight years have been in the Kansas City and Little Rock markets, Crain said.

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization